|

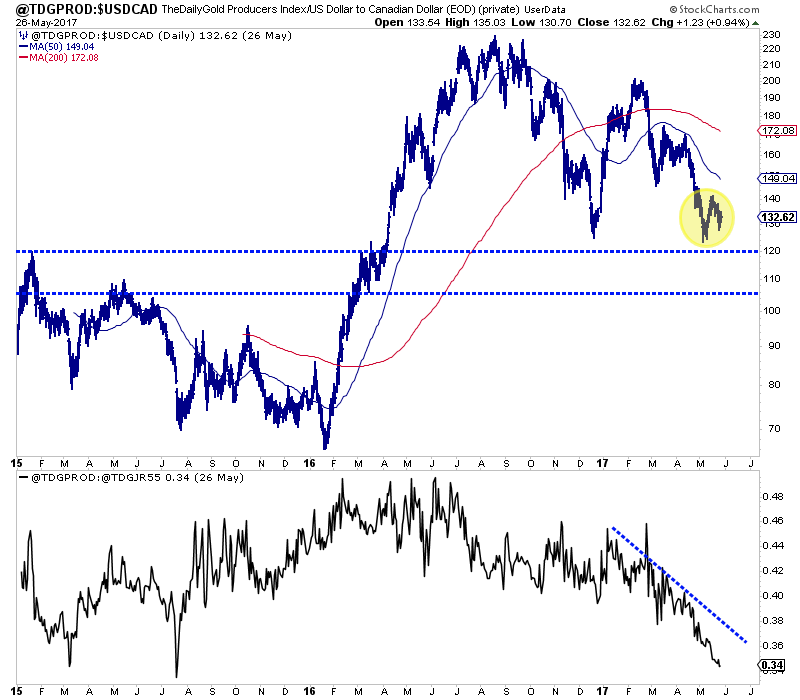

Chart 1: Producer Index of 11 Stocks

We created this index a few days ago. It is comprised mostly of junior producers but includes a few larger producers.

Producers are performing poorly and this suggests the market sees lower Gold prices in the weeks and months ahead.

Monday morning we sent subscribers a brief, 20-page update as we are in Vancouver at the Cambridge House conference. We remain cautious and bearish on the sector and are actively looking for new prospects/companies. We have found a few which we will discuss in the next few weeks. Below we share part of the summary which is on page 1 of every weekend update.

The same applies to the miners. In looking at GDX, GDXJ and our

55-stock junior index (p18), it is possible they could see a few days

of gains before touching strong resistance again. There have been huge

outflows in the ETFs in recent weeks and that could support the stocks

“holding up” a bit longer than expected as it is bullish from a

contrarian perspective. However, when GDX had huge outflows at the end

of 2012 and middle of 2013 it did not mark major market lows then.

I do not see a major bullish catalyst for precious metals until the

Fed’s done with rate hikes. Inflation has peaked for the year and

commodity prices have clearly rolled over. Even with the weak US$,

commodity prices have rolled over and precious metals remain below

important resistance. Furthermore, Gold has climbed back above $1260

but GLD continues to show no real increase in demand. In addition,

note the chart of a producer index of 11 stocks (p20). Its trading

near a 52-week low. Producers are anticipating a lower Gold price. I

did not have time to create an optionality index but I’m sure it would

look similar.

My hope is that the sector trades lower over the next 4-6 weeks,

creating a buying opportunity in July. The miners continue to be not

so oversold. GDX’s bullish percentage index remains at 39% and as of

Thursday, 37% of our 55-stock junior index was trading above both the

50-dma and 200-dma. Again, when these figures go to 15% or below we

will be nearing a low risk buying opportunity.

Consider a subscription today as we can help you get positioned in the junior companies with significant upside potential at reasonable entry points. This is exactly our plan in the months ahead.

Dr. Jeffrey Kern, who we recently interviewed, had this to say regarding our stock-picking abilities:

I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his

integrity.

Click Here to Learn More

And these are just a few examples of subscribers' praise......

Your doing an excellent job with your research and your reports! Timely, precise and damn accurate.

Your work is just too good to be missed. I'd like to have your ongoing assessments and views...

I appreciate your service and have some concept of the work that goes into it. Your stock picking is excellent.

I have subscribed to many investment research services over the years, both TA and FA, both within the gold sector and also from different sectors. Your report is right up there amongst the best.

I have been a subscriber for nearly 2 years now, and just wanted to let you know how much I appreciate the work you do. I always look forward to your weekly reports and find the analysis you present to be outstanding.

In my experience (over 30 years in PM’s), your service is one of great value and high integrity.

Thanks for all your great work - charts and analysis is the best there is.

Your service is truly a gem among this industry. I've subscribed to several services over the past year and a half, and I wish I had landed on your site first.

I'm a new member - just want to say how much I appreciate your expert advice but mostly, your direct, honest and zero bullshit approach.

Click Here to Learn More

We seek to own the companies with the best fundamentals that have the best risk/reward potential. We want to own the leaders while avoiding laggards with limited potential.

We tell you what we are buying and selling. Hence, we are completely transparent.

Consider a subscription today as you will receive all of our recent company reports and updates within several hours of your signup, as well as everything we produce for the next 6 months. You pay up front but get significant value up front (in a welcome email). Our goal is to help subscribers make

money and be the best service in its category.

Click Here to Learn More

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered

personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|