|

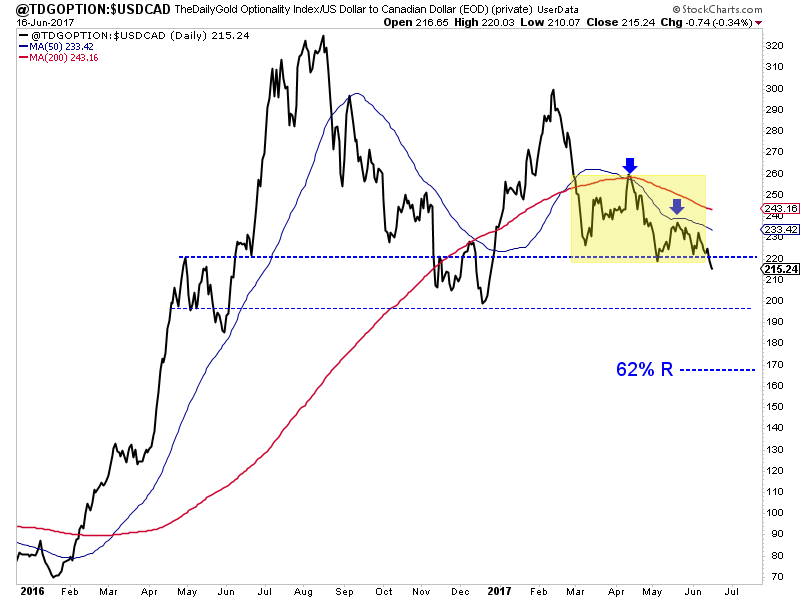

Chart 1: TheDailyGold Optionality Index

We included this in a premium update a few days ago though this chart is updated. The index is a basket of 13 optionality plays.

We included this in a flash update this past week and noted the index was about to break support at 220. The highlighted price action is nothing but bearish. Note the May peak at a confluence of resistance. The initial measured downside target is around 200 followed by 180. This is a very bearish chart.

Saturday evening we published TDG #522, a 34-page update which included, among other things, several pages of Q&A and a lengthy report on a company has become extremely oversold recently. We analyzed the company and projected price targets at $1050 Gold and $1550 Gold near the end of 2018 and a higher Gold price in 2019.

We reiterated our bearish posture on the sector. Its hard to feel otherwise after considering technicals and fundamentals. We think the sector is at risk of a potential dump lower over the next month. However, if our favorite companies became really cheap and oversold, we'd accumulate around those lows, even if we felt the sector could go lower later in the year.

Consider a subscription today as we can help you avoid losses and sidestep trouble. Our work will inform you as to what juniors you should be buying, at what prices and when.

Click Here to Learn More

Recent subscribers' comments......

I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of

any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity.

I am one of your premium subscribers and I cannot thank you enough for the detailed research and the analysis you provide on the gold mining stocks. It has made me to take better decision in the gold mining stock and your reports have been an invaluable guidance.

I have renewed, I have subscribed to many other types of newsletters but won’t be renewing with then . Yours I still like as you are sincere, dedicated and have a will to help and be of service .

TheDailyGold is my only subscription now and I enjoy it very much!

I look forward to receiving your newsletters and updates every week. They really help me understand what's happening in the PMs. Keep up the great work.

I am subscriber of yours. Just wanted to pass along a huge thank you for all your analysis and information you share. I was able to recoup my losses from the latter part of 2016, during my first 6month subscription with you, by adhering to your advice.

I have subscribed to many investment research services over the years, both TA and FA, both within the gold sector and also from different sectors. Your report is right up there amongst the best.

Click Here to Learn More

We seek to own the companies with the best fundamentals that have the best risk/reward potential. We want to own the leaders while avoiding laggards with limited potential.

We tell you what we are buying and selling. Hence, we are completely transparent.

Consider a subscription today as you will receive all of our recent company reports and updates within several hours of your signup, as well as everything we produce for the next 6 months. You pay up front but get significant value up front (in a welcome email). Our goal is to help subscribers make

money and be the best service in its category.

Click Here to Learn More

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered

personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|