|

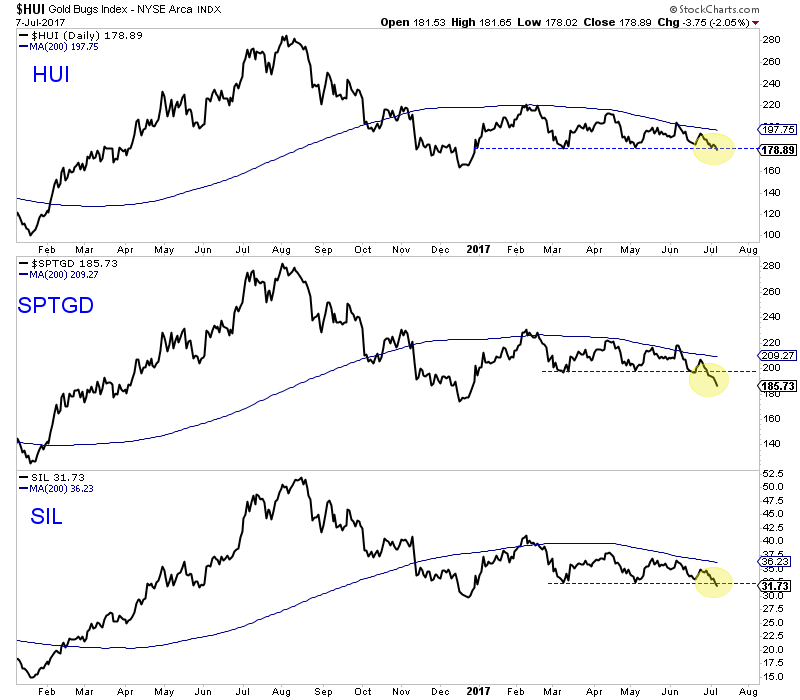

Chart 1: Mining Indices are Breaking Down

We plot the HUI, SPTGD and SIL. The HUI does not contain royalty companies like GDX while SPTGD is a CAD index. SIL is the silver stocks index.

These indices have all broken down to 7-month lows. They've broken their descending triangle patterns to the downside. This is very bearish and could lead to greater selling over the coming weeks and months.

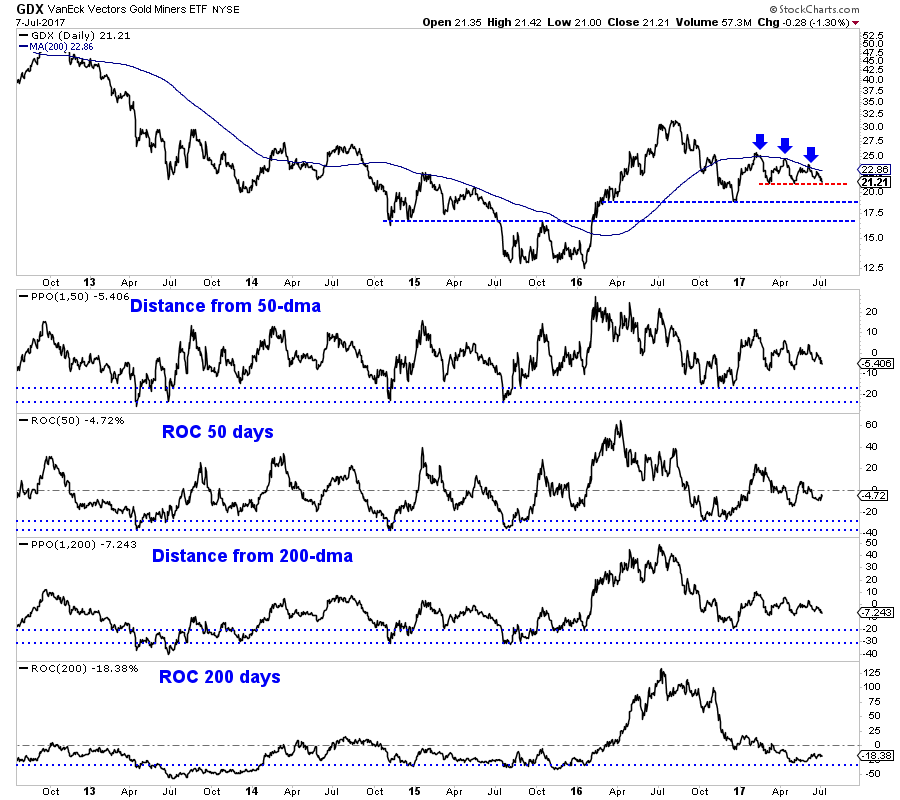

Chart 2: GDX w/ Oversold Indicators

This is the daily line chart of GDX with oscillators based on 50 and 200 day periods.

GDX has not broken below $21.00 yet but if the mining sector itself is any indication (meaning the indices above), then GDX will follow suit and break lower. The indicators at the bottom of the chart, based on 50 and 200 days are not close to oversold extremes.

We have been bearish and pounding the table about it to subscribers in recent weeks. In TDG #525, a 28 page update emailed to subscribers Saturday evening we stressed the bearish primary trend in precious metals and the sector starting to break now, technically. As a result, shorts and hedges should not be sold but better yet increased.

In the update we commented on the companies we own as far as recent developments, downside support levels and potential upside levels in roughly 2 years should Gold begin a bull market in early 2018. We also added two companies to our watch list: one that made a great discovery and is correcting significantly and another that has a current enterprise value of only $8M.

Consider a subscription today as we can help you avoid losses and sidestep trouble. Our work will inform you as to what juniors we want to buy, at what prices and when.

Click Here to Learn More

I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements

of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity.

-Dr. Jeff Kern, creator & developer of SkiGoldStocks Trading System

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered

personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|