|

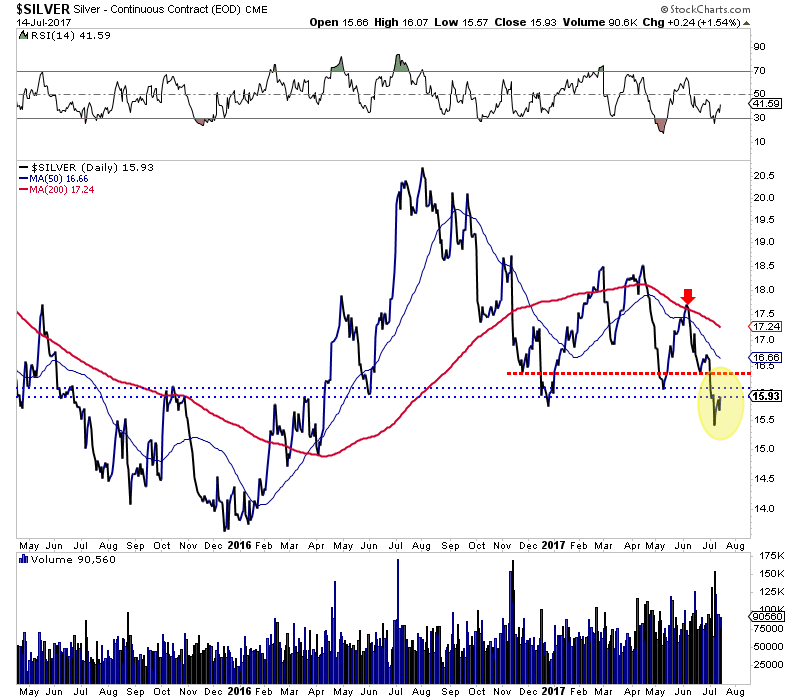

Chart 1: Silver Daily Line

We plot Silver's daily line chart along with its 50 and 200-day moving averages.

We have been short Silver via DSLV (3x short ETF) and it has worked very well albeit our position should have been larger. The thick red line is around $16.30. Look for Silver to rebound to $16.20-$16.30. The 50-dma is at $16.66 and declining. Throw in a few weeks of consolidation and Silver could come close to testing its 50-dma. That might be a time to short Silver again.

Commentary:

We had thought precious metals would head lower before a sentiment-based rebound but we were wrong and after last Monday we put out a flash update notifying subscribers of the potential for a rebound in the sector.

It will be interesting to see how long lasts considering the sharp reduction in the net speculative position in recent weeks. However, based on technical indicators the sector isn't that oversold and Gold's CoT is not below 10%. That could move back to 25% after a few weeks and in the context of a downtrend that could not be considered a low reading.

On another note, in TDG #526 (a 26-page update sent late Saturday) we covered a company that simply put, because of its upside potential is something we can't afford not to own. Sure, we are bearish on the sector but this is something that has potential to rise over the next 6-9 months even in this market. The potential over 3-5 years could be off the charts. We will be buying an intro position this coming week.

Consider a subscription today as we can help you avoid losses, sidestep trouble and get positioned in the juniors that have a chance to 5x-10x baggers over the next 2-3 years (like the one teased above).

Click Here to Learn More

I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements

of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity.

-Dr. Jeff Kern, creator & developer of SkiGoldStocks Trading System

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered

personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|