|

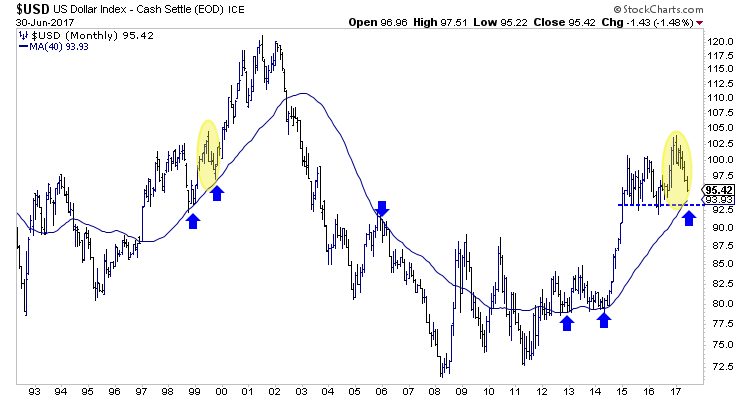

Chart 1: US$ Index Monthly Bar Chart

This is the monthly bar chart which includes the 40-month moving average.

Note how the 40-month moving average has provided support and resistance at key points over the past 20 years. The US$ index has corrected quite a bit but it is nearing a confluence of strong support at 93-94, which includes the 40-month moving average.

We should also note there are various comparisons that can be made with the current Fed hike cycle and the 1999-2000 period. The current decline in the US$ could be similar to the one in 1999.

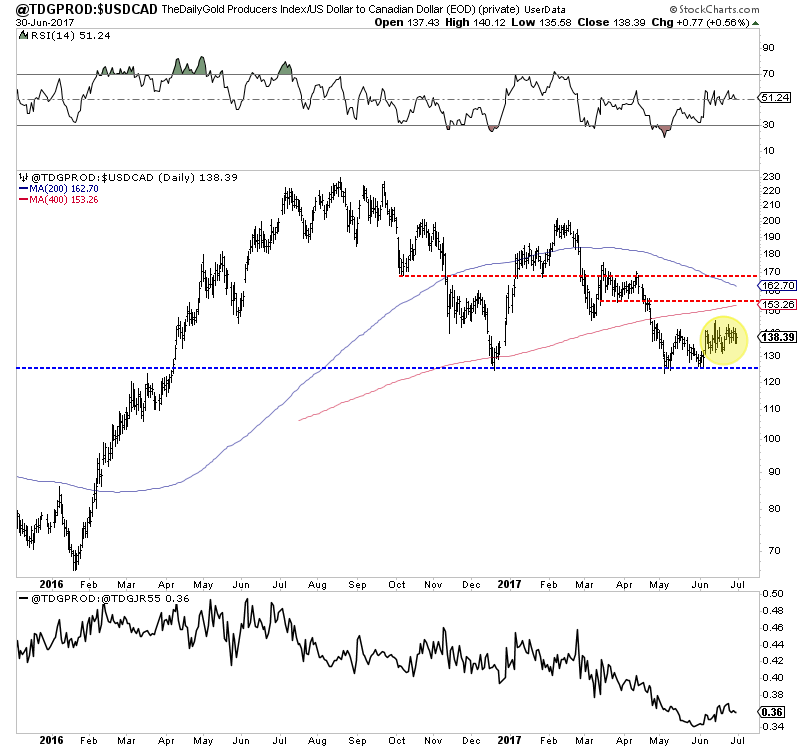

Chart 2: TDG Producers Index

This is the daily bar chart of our index of roughly 12 gold producers. Most are juniors and a few are a bit larger.

This index formed a solid double bottom into early June but has struggled to push higher. A true double bottom shows a very strong gain after the second low. The price action after this recent low is much different from the December 2016 low and January 2016 low.

The relative weakness of producers and the failure of the sector to perform strongly during a major US$ correction are two of many hints of what could lie ahead. In TDG #524, a 32-page update sent to subscribers Saturday evening we presented the evidence which makes a strong case that the precious metals sector could break lower in the days and weeks to come.

Consider a subscription today as we can help you avoid losses and sidestep trouble. Our work will inform you as to what juniors you should be buying, at what prices and when.

Click Here to Learn More

I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements

of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity.

-Dr. Jeff Kern, creator & developer of SkiGoldStocks Trading System

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered

personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|