|

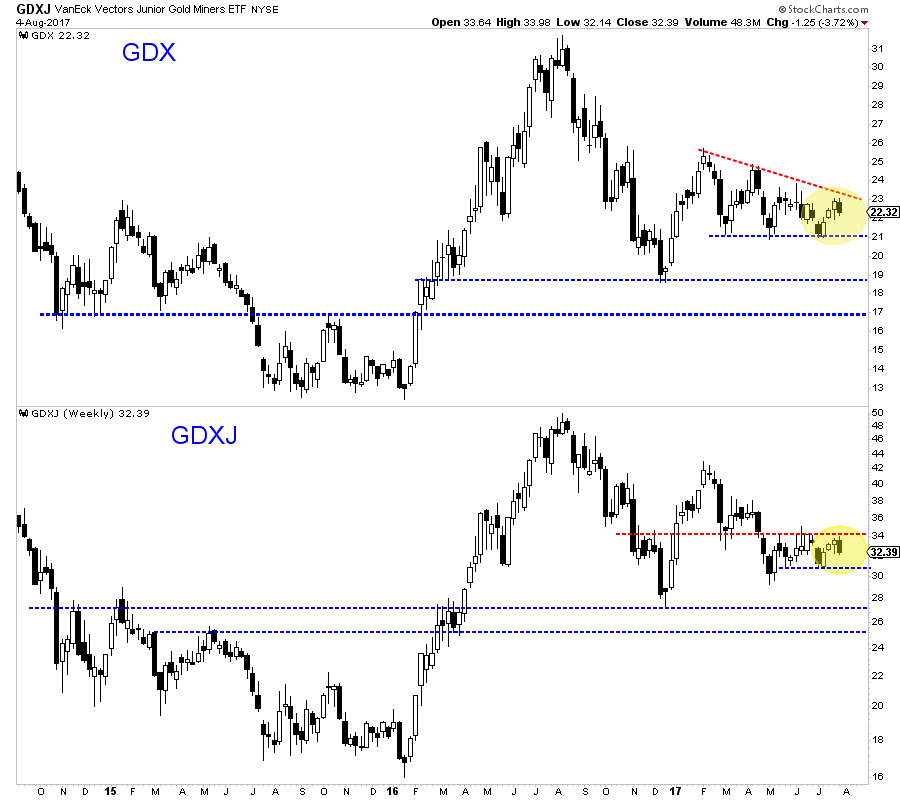

Chart 1: GDX & GDXJ Weekly Candles

Here are the weekly candle charts for both GDX and GDXJ

Both ETFs remain in tight ranges. The 3-week rally reset sentiment but the miners reversed course last week. GDXJ engulfed the previous two candles. Juniors are weaker than seniors right now.

Critical support for GDX is at $21.00 and GDXJ is at $31.00. If miners break those supports then there is potentially more downside after the break.

Commentary:

The US$ index formed a bullish hammer on the weekly chart right at support as precious metals sold off. In particular, juniors (GDXJ) and Silver painted nasty reversals on their charts.

Whats next?

Well, unless Gold can advance to $1300 then it has made a lower high and likely has $1200 in its sights. The same can be said for critical GDX support at $21. The US$ decline was not a boon for precious metals as it should have been. Now Gold and gold stocks have to prove they can hold support or they risk sizeable losses from here.

We remain very conservative but we have covered two must-own companies lately and TDG #529 included an intro report on one of the companies. It is something that every investor should own at least a small position in.

We remain conservative until the market breaks below support and gets really oversold or until Gold can break above $1300. Either way we remain patient and wait for the market to give us direction. With respect to companies we are, in the meantime, looking for incredible values or incredible potential and we've covered a few.

Consider a subscription today as we can help you avoid losses, sidestep trouble and get positioned in the juniors that have a chance to 5x-10x baggers over the next 2-3 years (like the ones teased above).

Note that we now have a members section to TheDailyGold.com. All updates are emailed to you and you can also download them from the website.

Click Here to Learn More

I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements

of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity.

-Dr. Jeff Kern, creator & developer of SkiGoldStocks Trading System

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered

personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|