|

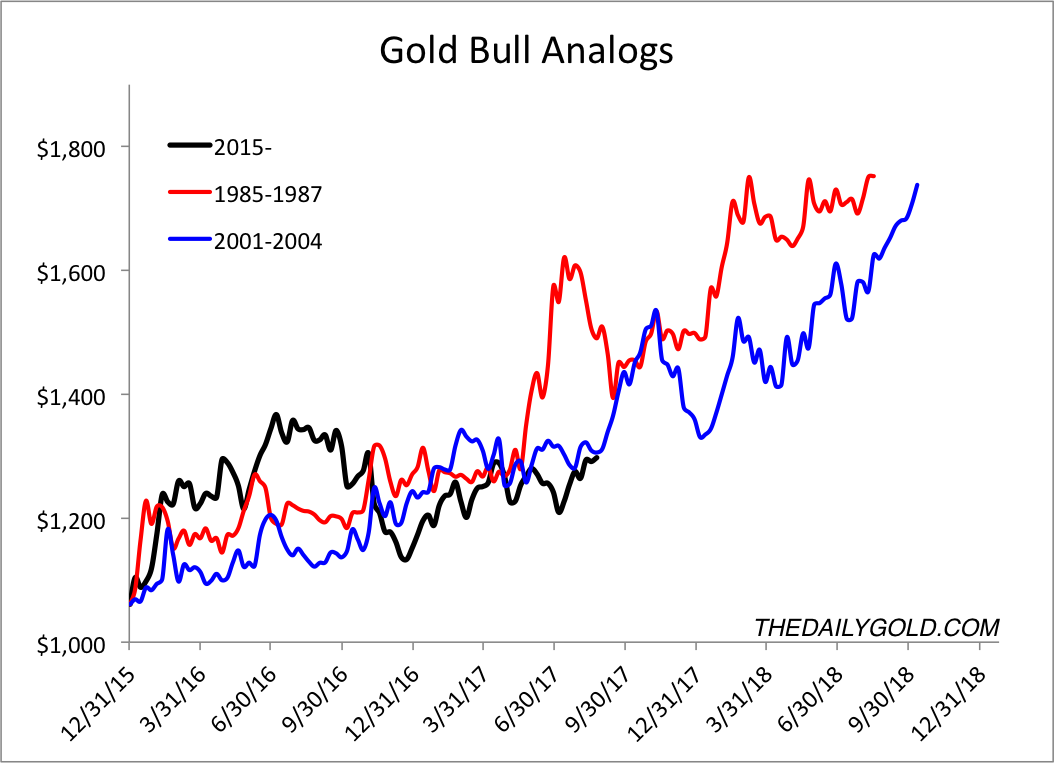

Chart 1: Gold Bull Analog

This is weekly data comparing the current rebound to the rebounds that began in 1985 and 2001.

In our premium updates, we have noted the similarities between the late 2015 low and the 1985 and 2001 lows. The price analog also makes for a strong comparison but for that comparison to be viable in the future then Gold needs to break above $1300 and eventually move above $1375 over the next few quarters.

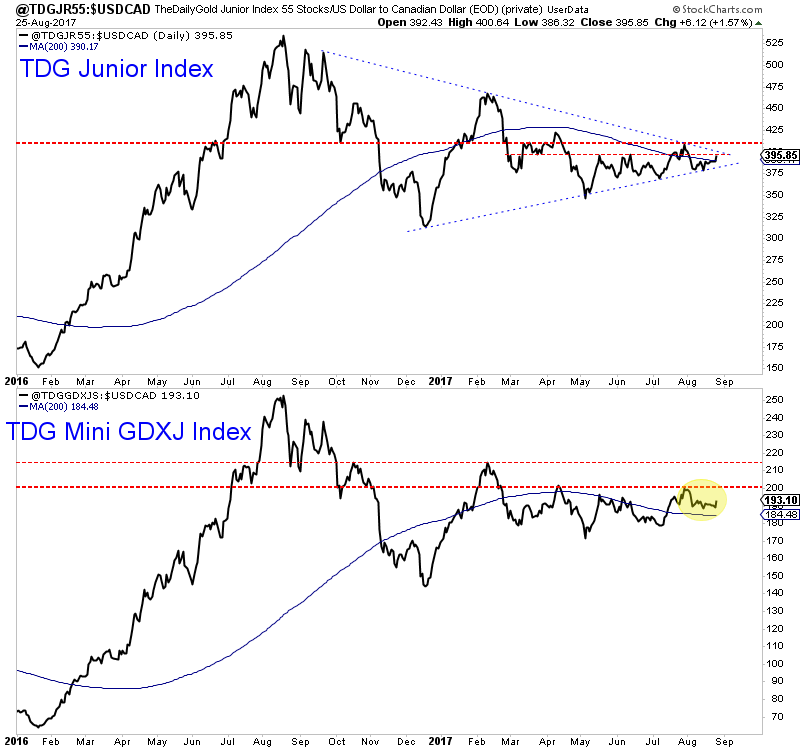

Chart 2: TDG Junior Index & TDG Mini-Junior Index

This is a daily line chart of the 55-stock index and the bottom half of that index, the mini index.

The main index continues to trade in a tightening range while the mini index has consolidated below 200 in bullish fashion. Both indices appear bullish. A daily close above the late July highs would be very bullish for both indices.

Commentary:

TDG #532, a 28-page premium update was published, uploaded to the members section and emailed to subscribers early Sunday.

While it is only a fledgling development, the gold stocks appear to be leading Gold. They were lagging from late winter through spring and then they matched Gold through most of the summer. In recent days many mining indices made slightly higher highs while Gold did not break $1300. Keep an eye on this because if the leadership from miners continues over the next few weeks then it would be very encouraging.

We added two companies to our watch list and we hope to buy one of those. The company is backed by a very strong group which boasts a record of multiple recent takeovers. The stock is trading well off its highs but has begun to rebound. The company's asset has seen quite a bit of work and past investment from a major. The company currently has an enterprise value of less than $30 Million.

These are the situations we are trying to find. Strong management, a good asset with potential and value- value in the company's current capitalization and value in the stock price.

Consider a subscription today in order to find out which companies we think our the best buys right now. We can help you get positioned in the juniors that have a chance to 5x-10x baggers over the next 2-3 years.

Note that we now have added a members section to TheDailyGold.com. All updates are emailed to you and you can also download them from the website. It would be an honor and pleasure to work for you.

Click Here to Learn More

I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements

of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity.

-Dr. Jeff Kern, creator & developer of SkiGoldStocks Trading System

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered

personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|