|

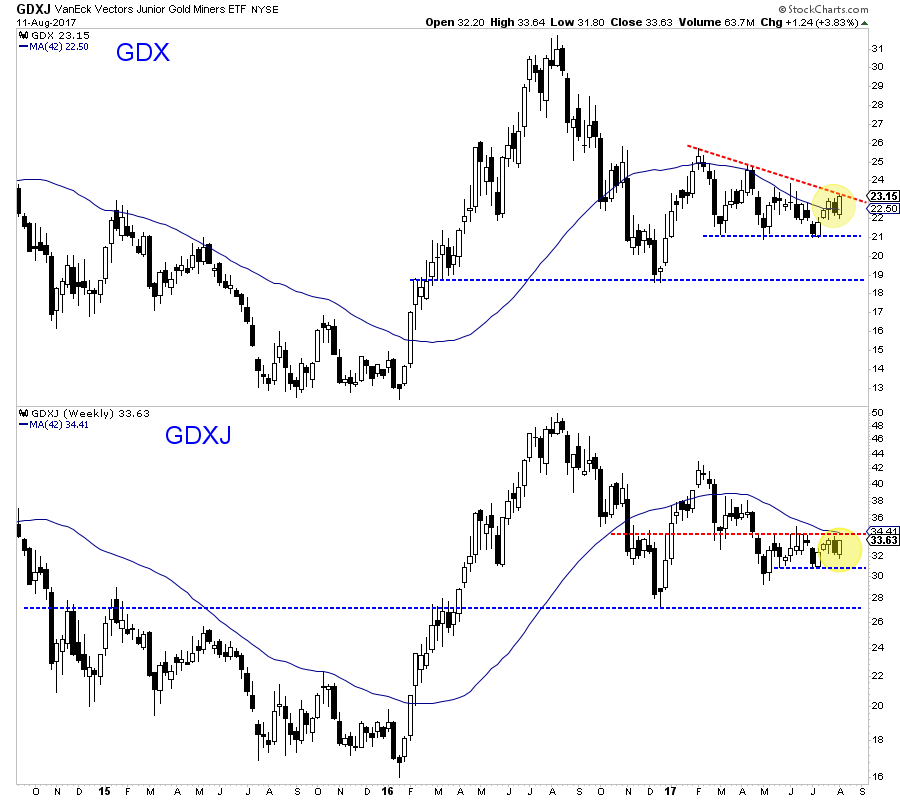

Chart 1: GDX & GDXJ Weekly Candles

Here are the weekly candle charts for both GDX and GDXJ

After last week, GDX closed well above last weeks high and at its highest weekly close since April. GDXJ closed near the highs of previous weeks at $33.63. A weekly close above $34 would mark a breakout. Meanwhile, GDX is very close to breaking its triangle resistance (on this weekly chart). It already has on the daily chart.

A weekly close above those red resistance lines would trigger an upside target of ~$25.50 in GDX and ~$38 in GDXJ.

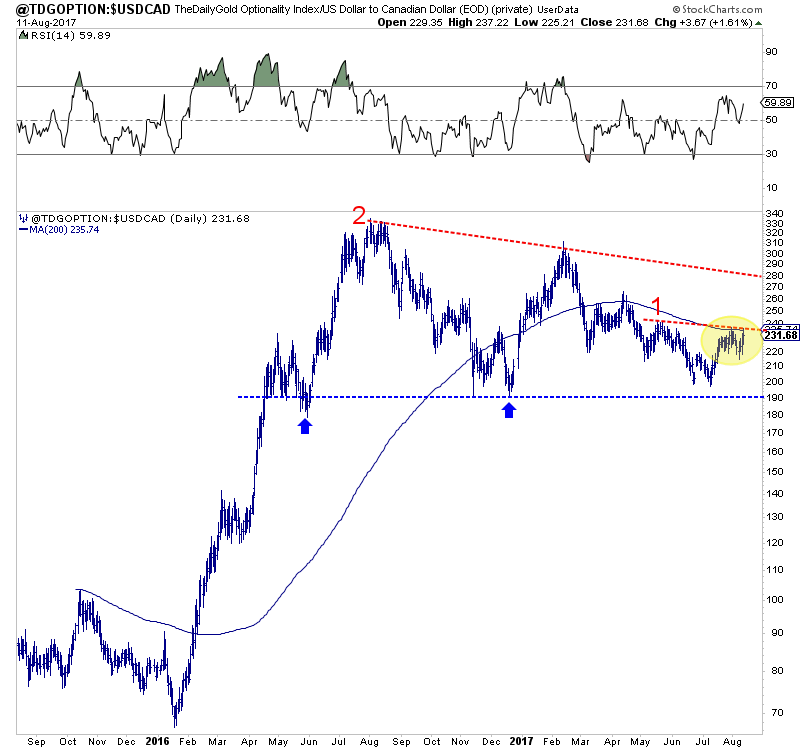

Chart 2: TDG Optionality Index

This is a daily bar chart of our equal weighted optionality index, which contains 12 companies.

The index recently formed a small double bottom around important support of 200. Circling back to 2016 we can see support around 190 was formed and then confirmed in December 2016. The index held above that support recently and rallied up to line 1. There is a mini H&SH pattern there and if the index breaks higher, its upside target is very close to line 2.

Commentary:

TDG #530, a 33-page premium update was published, uploaded to the members section and emailed to subscribers early Sunday AM.

We covered the outlook for the sector and among other things, commented on the latest developments in a handful of companies we own (p4-p6).

Below is part of our page 1 summary:

We have officially turned bullish (as per recent flash updates) as Gold has perked up in real terms exactly when it had to and as Gold and gold stocks trade very close to key resistance levels. Gold has already rallied back to as high as $1294 and the most encouraging thing is it is a broad based move in real terms. In other words Gold is suddenly trending higher against foreign currencies, equities and bonds in unison. That is the seeds of a real Gold bull market, not what

we’ve seen for most of 2017: a surging stock market, weak US$ and muted gains in precious metals. It is a fledgling development but if it continues it should carry Gold through $1300. Most important is the outperformance (of Gold) against the stock market.

The North Korea story has certainly helped Gold and if/when tensions calm down Gold could come off by $20-$30 before making a run again at $1300. Key daily support is at $1280 and $1260. The US$ index could also rally but as we answer in the Q&A section, Gold has been more tied to the Yen which has a slightly stronger case than the US$ for a sentiment rally. If Gold remains strong in real terms that can mitigate the impact of a stronger US$.

Consider a subscription today in order to find out which companies we think our the best buys right now, including one company we hope to make our biggest position. We can help you get positioned in the juniors that have a chance to 5x-10x baggers over the next 2-3 years (like the ones teased above).

Note that we now have added a members section to TheDailyGold.com. All updates are emailed to you and you can also download them from the website.

Click Here to Learn More

I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements

of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity.

-Dr. Jeff Kern, creator & developer of SkiGoldStocks Trading System

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered

personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|