|

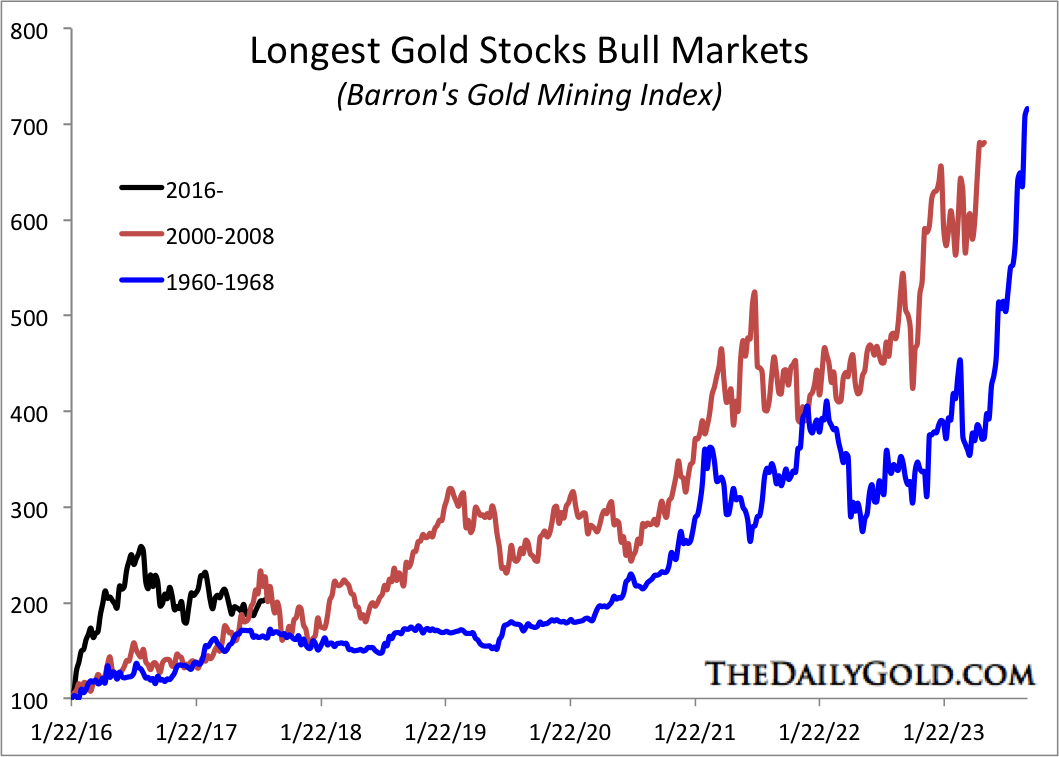

Chart 1: BGMI Bull Analog

This is weekly data comparing the bull markets in gold stocks (Barron's Gold Mining Index) that began in 1960, 2000 and 2016 (three of the secular low points for gold stocks).

At present, the current bull is sitting between the other two.

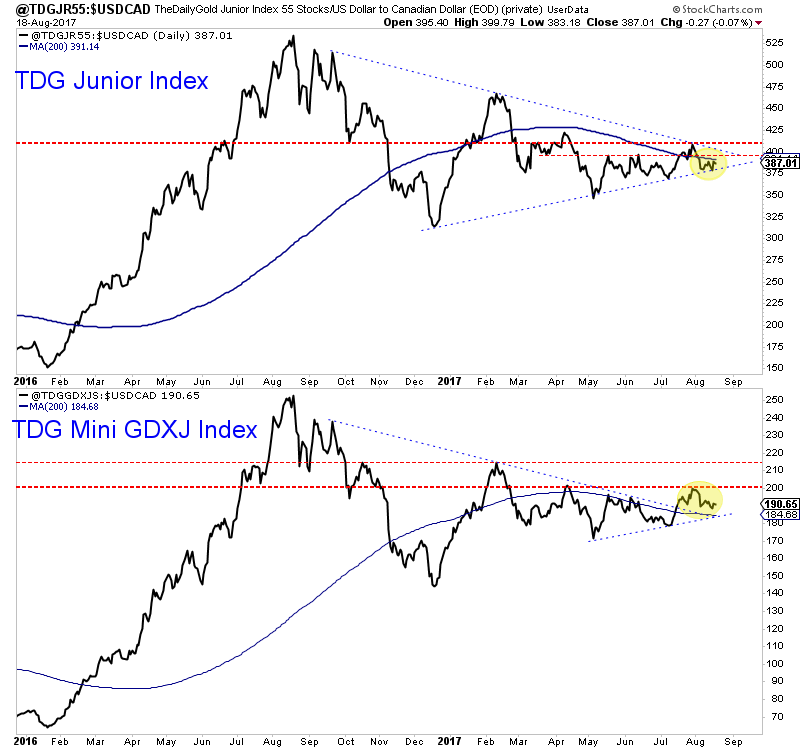

Chart 2: TDG Junior Index & TDG Mini-Junior Index

This is a daily line chart of the 55-stock index and the bottom half of that index, the mini index.

The main index has traded in a tighter and tighter range and there is little room left to maneuver without breaking. Meanwhile, the mini index has already broken its downtrend. A move above 200 would confirm a breakout while the main index (which closed at 387) needs a move above 408.

Commentary:

TDG #531, a 21-page premium update was published, uploaded to the members section and emailed to subscribers late Saturday. We discussed our short-term outlook for precious metals, short-term support targets for Gold and gold stocks as well as the junior miners we think are buys right now.

We mentioned two that have consolidated within ranges for months but are starting to trend toward resistance. Both companies have tremendous people involved and some high quality assets.

We noted another company we added to the portfolio this past week, though it does not trade in North America. It is trading at an incredible value (less than US$15 Million market cap), is cashed up and has a joint venture with a major that is funding exploration at one of the projects. As much as $8M could go into the company's projects over the next two and a half years and its market cap is only $7M more than that!

Of course this does not include a company that made a recent discovery that has become our largest position.

Consider a subscription today in order to find out which companies we think our the best buys right now. We can help you get positioned in the juniors that have a chance to 5x-10x baggers over the next 2-3 years (like the ones teased above).

Note that we now have added a members section to TheDailyGold.com. All updates are emailed to you and you can also download them from the website. It would be an honor and pleasure to work for you.

Click Here to Learn More

I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements

of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity.

-Dr. Jeff Kern, creator & developer of SkiGoldStocks Trading System

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered

personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|