|

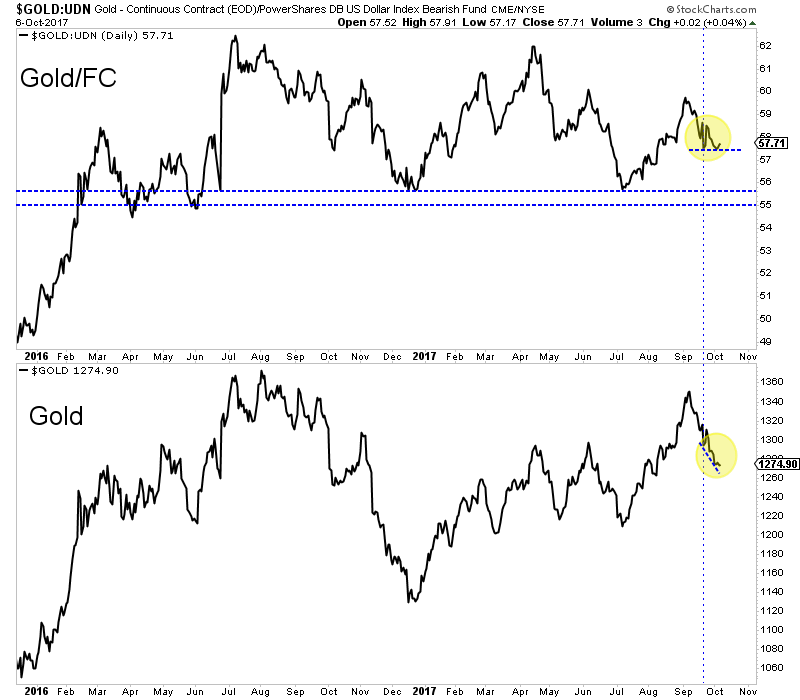

Chart 1: Gold & Gold/Foreign Currencies

Since September 20, Gold has made news while Gold/FC has not. That tells us that Gold is showing relative strength and that its weakness is entirely US$ driven. Now the US$ is set for at least a brief pullback and Gold should bounce to at least $1300.

My bias for the medium term is to the downside as I think the US$ rally has more to go. One thing I will be watching is the Gold/FC chart, shown below. Will Gold/FC continue to hold above its 2016 and 2017 lows? If so, it bodes well for Gold over the next 12 months.

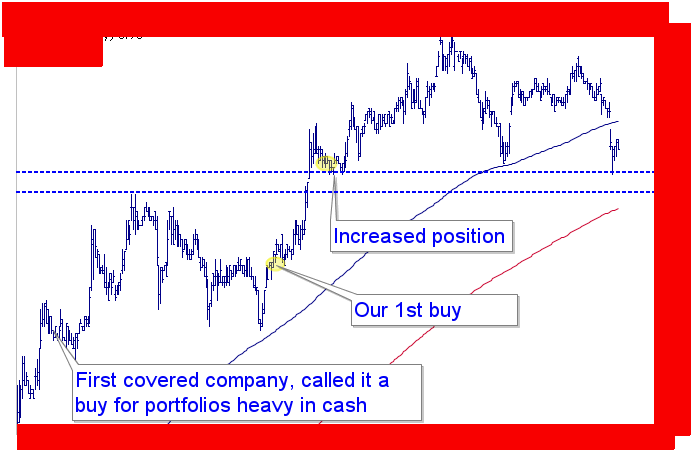

Chart 2: Case Study

Here is a look at how we approach buying companies and how we advise subscribers....

We discovered this company in summer 2016 when met with them at a conference. Had we had a lot of cash at the time we would have bought. We were patient and bought just after the sector's bottom in December 2016 (when we had more cash). We added a bit to it later.

The stock kept moving higher but for various reasons we advised new subscribers to hold off. The stock would likely remain in a long consolidation and that has been playing out. The company is now cashed up, the stock has corrected more and the company is trading at good value. It is fairly close to strong support. We would still be patient as we think there could be a better opportunity over the next few months.

The horizontal lines are clearly important support and can help us mark a low risk entry point as well as define our risk.

It appears that precious metals have started a bounce, which would correct the oversold condition left from a strong selloff over the past 3-4 weeks. While the internals suggest the bounce could run for more than a few days, they would need to strengthen more for us to think the rebound would have

legs. Therefore we are not chasing this strength. We are wary as we expect lower prices into November.

Given our view, we remain in a holding mode as we hope to buy value and buy oversold conditions. It has served us very well since the low last December.

Consider a subscription today. We can help you get positioned in the juniors that have a chance to 5x-10x baggers over the next 2-3 years. We look for value with a catalyst and then we wait for a proper, low risk entry point.

Note that we have added a members section to TheDailyGold.com. All updates are emailed to you and you can also download them from the website.

It would be an honor and pleasure to work for you. My subscribers are my lifeblood.

Click Here to Learn More

I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his

integrity.

-Dr. Jeff Kern, creator & developer of SkiGoldStocks Trading System

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that

can cause results and outcomes to differ materially from those discussed herein. Novo Resources has contracted TheDailyGold.com for marketing purposes.

|