|

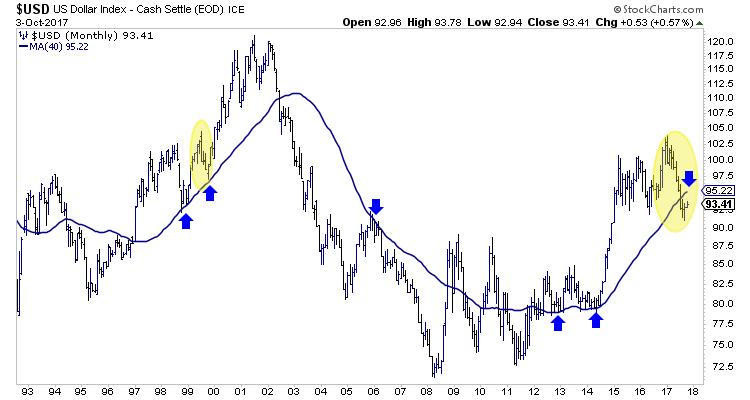

Chart 1: US$ Monthly Chart

This is the monthly bar chart with the 40-month moving average.

The 40-month moving average has done an excellent job defining the long-term trend. The recent decline in the US$ took it below its 40-month moving average which sits at +95 and is rising. The index has rallied from 91 to nearly 94 already.

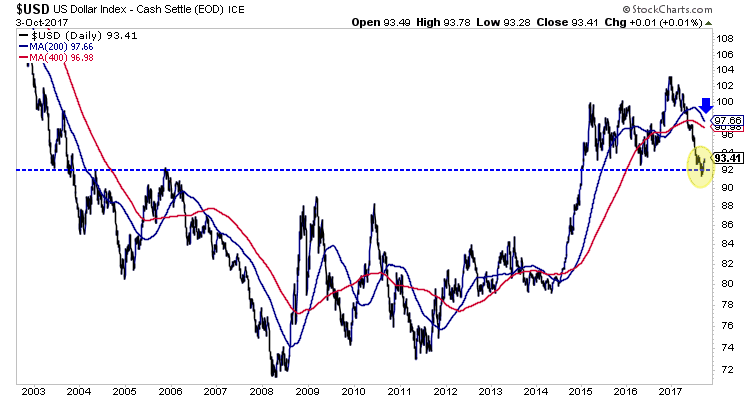

Chart 2: US$ Daily Line Chart

This is the daily line chart and it includes the 200-day moving average and 400-day moving average.

Note, the moving averages are at 97.66 and 96.98. There is a potential H&SH pattern developing that projects to a target of 97. So the 40-month moving average could reach 96 soon, the moving averages are around 97 and a technical pattern projects to 97.

Commentary:

In a flash update published Tuesday morning we discussed the US$'s potential upside target of 97. We also noted that the greenback was approaching short-term resistance along with the 10-year yield. In TDG #537 published Sunday evening we noted that precious metals were a few days away from a rebound. It looks to have begun.

That being said, I do not have high hopes as I don't expect precious metals to rebound close to recent highs. Fundamentals for Q4 appear to be bearish and the charts are as well. Recall that precious metals did not do much in the face of a weak US$. Now that the greenback is rallying from an oversold condition, precious metals are under pressure and need to build relative strength.

If the US$ rally peters out around major resistance at 96-97 and turns lower in early 2018 then that could fuel Gold for another test of major resistance above $1350. A stock market correction brought about by higher yields and higher inflation would be another potential catalyst for the sector. But the road to get to that point (rising yields, rising inflation) is bearish for Gold at first. Did that road begin in mid September?

Given our view, we are in a holding mode as we hope to buy value and buy oversold conditions. It has served us very well since the low last December. Sure, we were stopped out on a few buys but 7 of the positions in the portfolio were bought this year and are up an average of 120%. Six of those (as of Sunday) were up 89% or more.

Consider a subscription today. We can help you get positioned in the juniors that have a chance to 5x-10x baggers over the next 2-3 years. We look for value with a catalyst and then we wait for a proper, low risk entry point.

Note that we have added a members section to TheDailyGold.com. All updates are emailed to you and you can also download them from the website.

It would be an honor and pleasure to work for you. My subscribers are my lifeblood.

Click Here to Learn More

I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements

of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity.

-Dr. Jeff Kern, creator & developer of SkiGoldStocks Trading System

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered

personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|