|

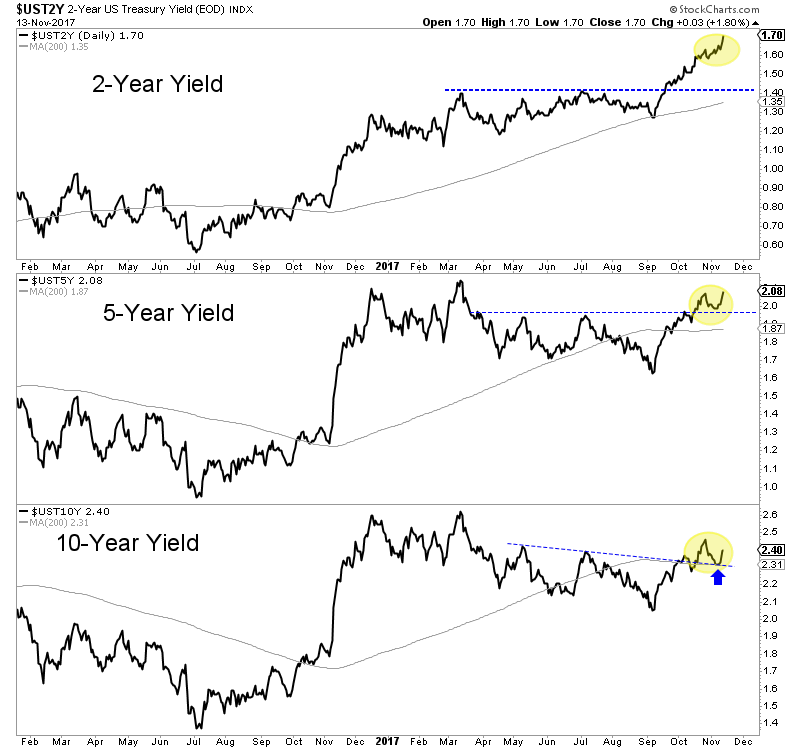

Chart 1: Bond Yields

Rising bond yields are negative for Gold if inflation is not rising faster or if the yield curve is not steepening. If inflation is rising faster than short-term yields than real rates decline and the yield curve will steepen. In other words, the 10-year yield will rise faster than the 2-year yield.

The problem for Gold right now is yields across the board are rising and the curve is not steepening. The 2-year yield, a proxy for the Fed funds rate is at 1.70%. That essentially is already starting to price in a second hike. The 5-year and 10-year yields will make significant breakouts if they takeout the March highs. The breakouts would likely be bearish for Gold but decreasingly so.

The past few weeks have been quite busy for TheDailyGold. We presented days ago at the Metals Investor Forum in Vancouver and published our usual weekly update. This one, TDG #543 included our short-term thoughts on the sector.

The technicals concern us very much and the threat of rising nominal yields would be a fundamental negative for precious metals in the near term. Its only bullish when inflation expectations increase and long-term rates begin rising faster.

That being said, there is something important I shared in my presentation and with subscribers in recent days. Specifically, I'm looking at 3-5 year bear markets of +80% and what happened in the years that followed. These markets followed a specific recovery path. This recovery path implies that the gold stocks should begin a major move higher sometime next year. We will share more details in the future as to when the move could begin, how far it could go and how long could it

last.

Consider a subscription today. We can help you get positioned in the juniors that have a chance to 5x-10x baggers over the next 2-3 years. We look for value with a catalyst and then we wait for a proper, low risk entry point.

It would be an honor and pleasure to work for you. My subscribers are my lifeblood.

Click Here to Learn More

You nearly always read the trends and support and resistance extremely well. Please keep us posted if or when the outlook seems to change. which you always do of course. TDG is the most valuable resource for understanding what is possible to understand about the PMs.

I am very pleased with your frequent and timely updates, which is so helpful, considering the high volatility and unpredictability of this market. I have subscribed to other analysts which I have to say don't even come close.

I would add that you are moving to the top of my most valuable mining stock/metals advisor list. Your skills at chart reading have improved over the years, to very high levels. Kudos for that. Your advice on capital preservation in this dangerous trading arena are reliable, as well. In the years ahead, I believe you will continue to rise to the top.

I plan to be a lifetime subscriber to your service....I have made a lot of money with your service...especially with Novo which because of your recommendation I was able to acquire at $1.30.

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that

can cause results and outcomes to differ materially from those discussed herein. Novo Resources has contracted TheDailyGold.com for marketing purposes.

|