|

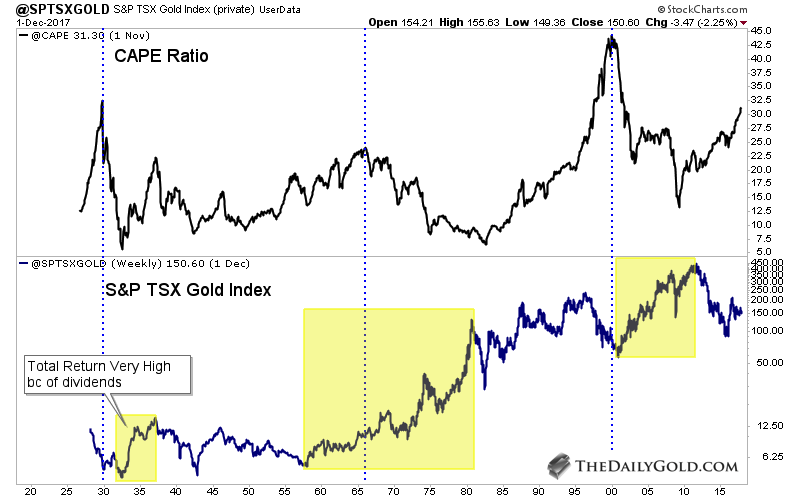

Chart 1: CAPE Ratio & Gold Stocks

In this chart we plot the infamous Schiller CAPE Ratio (PE Ratio for 10-year earnings) along with the gold stocks (S&P TSX Gold Index).

There are not many data points but isn't it interesting how the gold stocks have performed fabulously following major peaks in CAPE? Gold stocks formed a major low several years before the CAPE peak in the mid 60s. Perhaps CAPE will peak in 2018 or early 2019? In any event, we think gold stocks will produce fabulous returns over the next 5 and 10 years.

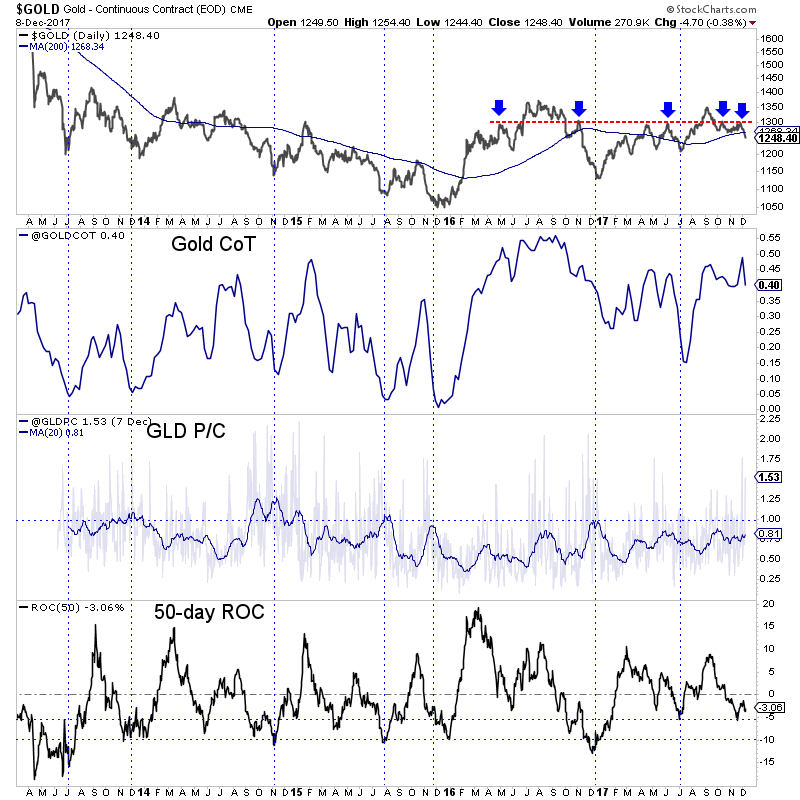

Chart 2: Gold Sentiment & 50-Day ROC

In this chart we plot Gold along with the CoT (net specs/open interest), the GLD put-call ratio and a simple 50-day rate of change (ROC) which can be used as an oversold indicator.

Gold recently failed at $1300 twice and has broken below $1260 and the 200-dma. We think its headed to $1220 and perhaps soon. The put-call is at 0.81. A reading of 1.00 would mark a bearish extreme. The ROC would need to reach -10% to mark an oversold condition. So these indicators tell us Gold has some more work to do on the downside before sentiment reaches a bearish extreme. Perhaps that happens when Gold falls into its next strong support at $1200-$1220?

Early Sunday morning we published, TDG #547, a 32-page update which included, among other things, an updated report on one of our holdings. The company has a solid, economic project and has been a winner for us. We analyzed how much it could be worth in the future and when and at what prices it would be a good buy again.

We also shared our views on the sector which (ex-Gold) is getting oversold and could be setting up for a bounce to start the year. However, technicals and sentiment are not yet at true extremes and the fundamentals are not in place. Thus, we think lower lows could be coming at the end of winter or perhaps in early spring. We think the next big move higher could begin around summer. That means weakness in the months ahead could setup some great buying opportunities. There may be a few here

and now but my guess is most buying opportunities will arise after winter or early spring.

If you exercise patience, buy at opportune times (sector oversold, stock oversold, value, etc), choose the right companies and cut your losses, you can achieve good results. Now is a great time to consider a subscription as we have begun to update all of our company reports and will produce some new ones. It would be an honor and pleasure to work for you.

Click Here to Learn More

You nearly always read the trends and support and resistance extremely well. Please keep us posted if or when the outlook seems to change. which you always do of course. TDG is the most valuable resource for understanding what is possible to understand about the PMs.

I am very pleased with your frequent and timely updates, which is so helpful, considering the high volatility and unpredictability of this market. I have subscribed to other analysts which I have to say don't even come close.

I would add that you are moving to the top of my most valuable mining stock/metals advisor list. Your skills at chart reading have improved over the years, to very high levels. Kudos for that. Your advice on capital preservation in this dangerous trading arena are reliable, as well. In the years ahead, I believe you will continue to rise to the top.

I plan to be a lifetime subscriber to your service....I have made a lot of money with your service...especially with Novo which because of your recommendation I was able to acquire at $1.30.

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that

can cause results and outcomes to differ materially from those discussed herein. Novo Resources has contracted TheDailyGold.com for marketing purposes.

|