|

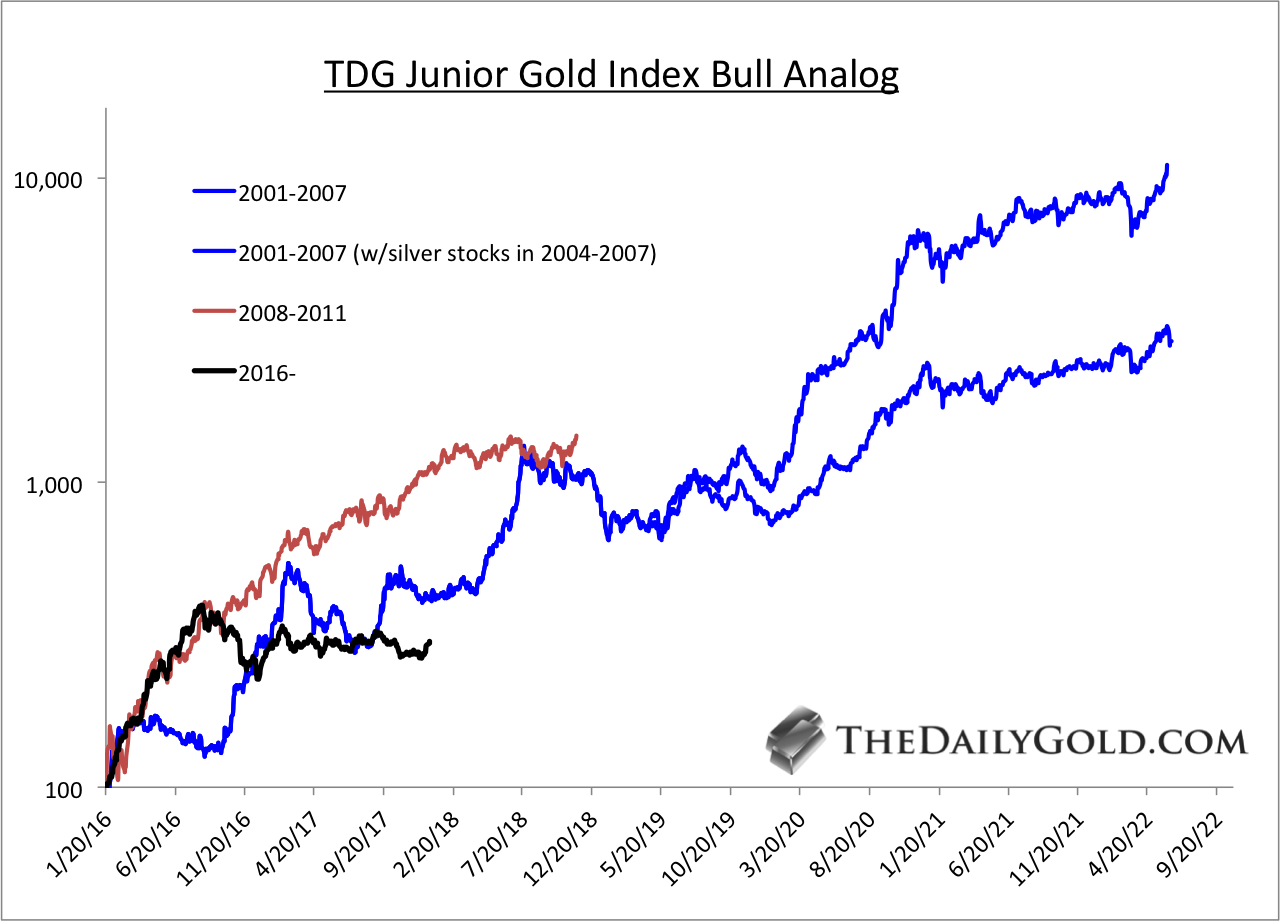

Chart 1: TDG Junior Bull Analog

The current bull began January 2016. It is now starting the 18th month of its correction and consolidation. The juniors had a similar consolidation from 2002-2003 (in blue) and it lasted 13 months. The market was stronger during that consolidation as twice it rallied back close to the previous high. That has not happened since the peak in summer 2016.

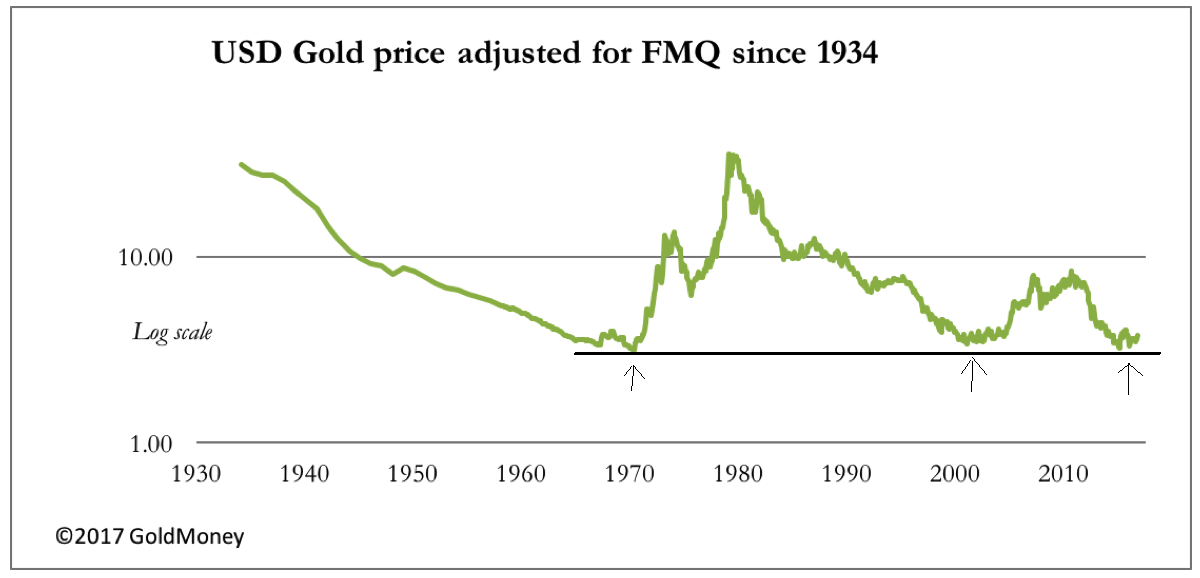

Chart 2: Gold vs. Fiat Money Quantity

It is amazing that Gold relative to fiat money is only slightly above the 2016 low which compares well with the 2001 low and 1970 low. In other words, relative to all the fiat money in the US, Gold is nearly as cheap as it was at the secular lows of 1970 and 2001. Credit to GoldMoney for this great chart.

Saturday evening, we published TDG #551, a 32-page update that included coverage of a number of companies and a number of charts.

This update included, among other things, notes on five companies, two of which we do not own (p3-p4), Q&A on two other companies (p5), updated junior bull analog charts (p20-p21) and some historical Gold & Silver charts (p7-p9). (Two of the charts are shared above).

One of the five companies mentioned which we do not own looks like a great buy. It is fundamentally undervalued and could be acquired in the next year. The chart looks great. And the company has a catalysts coming. These are the factors we are looking for. It may not be a 3-5 bagger but we think it could rise 100%-150%.

If this is going to be a big breakout year for Gold (or in 2019) then we want to try and find the deep value juniors left that have a chance to be 5-10 baggers.

Not a subscriber? Now is the time to get serious about this sector. Do not wait for the sector to breakout and be forced to buying stuff that is already moved 100%.

Learn More About & Subscribe to Our Service

You nearly always read the trends and support and resistance extremely well. Please keep us posted if or when the outlook seems to change. which you always do of course. TDG is the most valuable resource for understanding what is possible to understand about the PMs.

I am very pleased with your frequent and timely updates, which is so helpful, considering the high volatility and unpredictability of this market. I have subscribed to other analysts which I have to say don't even come close.

I would add that you are moving to the top of my most valuable mining stock/metals advisor list. Your skills at chart reading have improved over the years, to very high levels. Kudos for that. Your advice on capital preservation in this dangerous trading arena are reliable, as well. In the years ahead, I believe you will continue to rise to the top.

I plan to be a lifetime subscriber to your service....I have made a lot of money with your service...especially with Novo which because of your recommendation I was able to acquire at $1.30.

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements

of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. - Dr. Jeffrey Kern, SkiGoldStocks.com

Learn More About & Subscribe to Our Service

Thanks for reading. I wish you all great health and prosperity in 2018!

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that

can cause results and outcomes to differ materially from those discussed herein. Novo Resources has contracted TheDailyGold.com for marketing purposes.

|