|

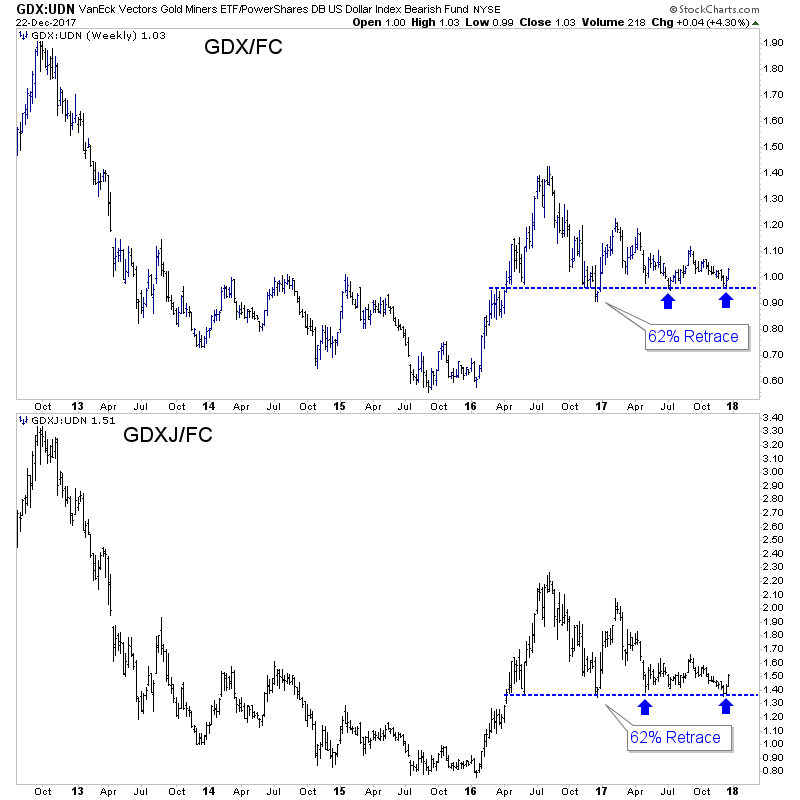

Chart 1: Gold Stocks vs. Foreign Currencies

We always plot Gold against FC but rarely have we analyzed gold stocks while denominated in FC. The chart below plots GDX and GDXJ against FC (inverse of US$ index basket).

These charts look encouraging for gold stocks. They have held above important lows multiple times since December 2016. And that includes holding above the 62% retracement. The US$ is an important factor obviously but nonetheless, these charts are encouraging for bulls.

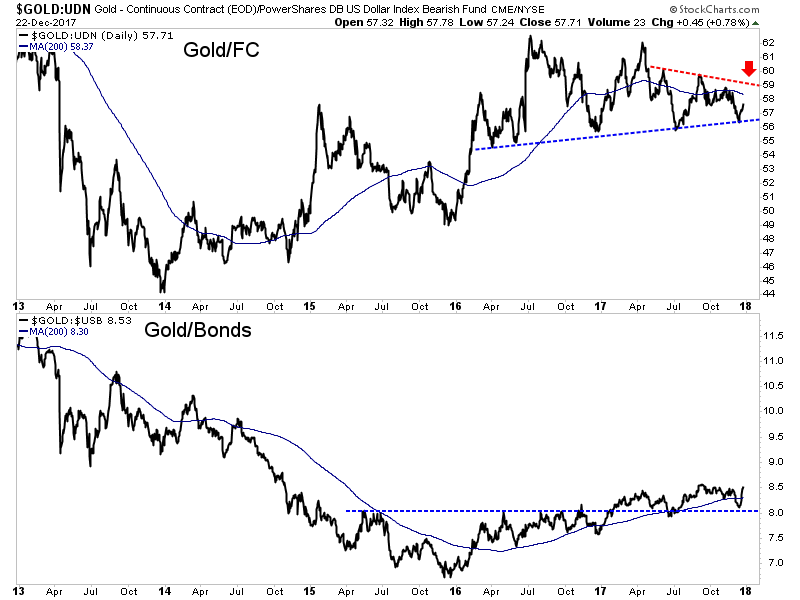

Chart 2: Gold vs. FC & Bonds

Here we plot Gold against FC and Gold against Bonds.

Gold remains very weak relative to the stock market but it is trending higher relative to Bonds. Gold/FC has a confluence of resistance at 58-59. It closed at 57.71. If Gold/FC can surpass 59 and the red trendline it would greatly increase the odds that the 2016-2017 action is not a massive topping pattern.

Saturday evening we published TDG #549, a 34-page update.

It included (among other things) two company reports as well as an update on Novo Resources. One of the companies we covered was one of our biggest winners in 2016 but the stock has corrected, is trading at a reasonable value and the company is drilling some very exciting targets right now. The other company was a big winner for us in 2017 but it has since corrected. We waited and waited before calling it a buy again. It has rallied +10% since then.

The rebound in the sector we expected has been much stronger than we expected. Our upside targets were hit quickly! That momentum coupled with some bearish sentiment tells me the rally has some more upside, even though miners will encounter resistance soon.

As far as sentiment, the net spec position in Silver is at its lowest in +2 years at only 9.1%! Meanwhile, the GLD put-call ratio just hit its highest level in +2 years! Sentiment is not at a bearish extreme across the board but it is fairly encouraging for more upside.

What is also encouraging is the long-term value (5 charts article) in the sector. We often obsess over the wiggles and forget that the big picture is extremely promising.

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity.

- Dr. Jeffrey Kern, SkiGoldStocks.com

Click Here to Learn More

You nearly always read the trends and support and resistance extremely well. Please keep us posted if or when the outlook seems to change. which you always do of course. TDG is the most valuable resource for understanding what is possible to understand about the PMs.

I am very pleased with your frequent and timely updates, which is so helpful, considering the high volatility and unpredictability of this market. I have subscribed to other analysts which I have to say don't even come close.

I would add that you are moving to the top of my most valuable mining stock/metals advisor list. Your skills at chart reading have improved over the years, to very high levels. Kudos for that. Your advice on capital preservation in this dangerous trading arena are reliable, as well. In the years ahead, I believe you will continue to rise to the top.

I plan to be a lifetime subscriber to your service....I have made a lot of money with your service...especially with Novo which because of your recommendation I was able to acquire at $1.30.

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that

can cause results and outcomes to differ materially from those discussed herein. Novo Resources has contracted TheDailyGold.com for marketing purposes.

|