|

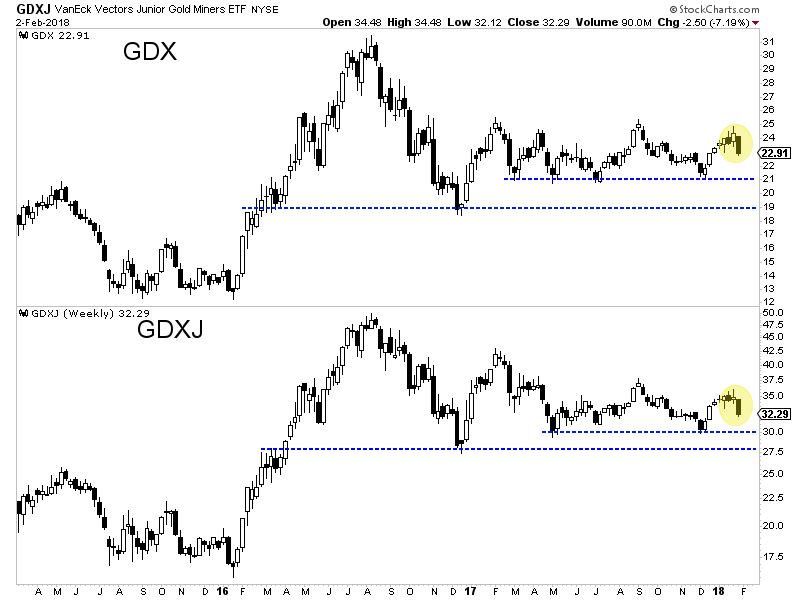

Chart 1: GDX & GDXJ Weekly Candles

Here are the weekly candle charts for GDX and GDXJ.

The miners lost 6% and 7% on the week and printed some nasty bearish candles which engulfed recent weeks of gains. Odds now favor GDX and GDXJ retracing the majority of recent gains. Will they retest December 2017 lows at $21 and $29.50?

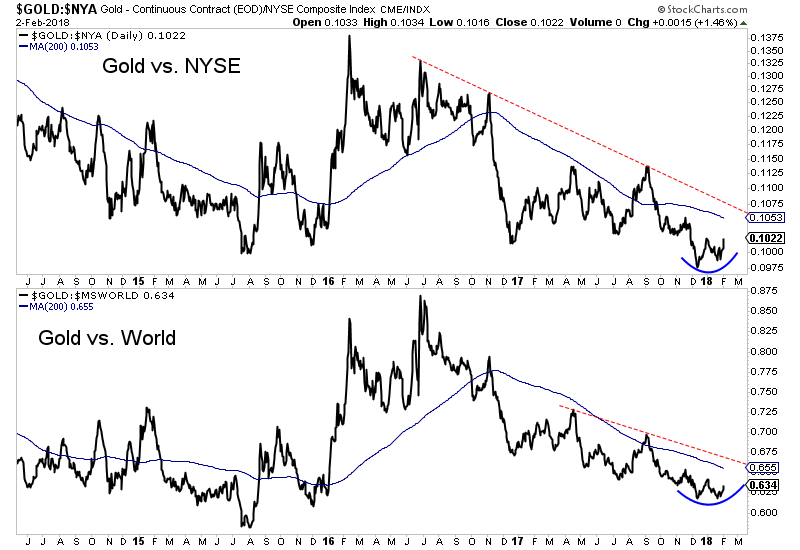

Chart 2: Gold vs. Stocks

We plot Gold against the NYSE and then Gold against the World ex the USA.

Gold vs. Stocks bottomed in summer 2015 ahead of the sector. If these ratios are able to break above the red trendlines, that would be obviously be bullish for the sector. The potential outperformance of Gold here could lead the potential major breakout in the sector.

Saturday evening, we published TDG #554, a 26-page update which focused on the technical support points for the sector as well as buy targets for our favored companies.

The 12-18 month outlook for precious metals remains very bullish but it will take the sector some time to get in position for the major breakout. In the meantime, we have to accumulate weakness and identify the stocks with value and explosive potential when the sector does breakout and run. In the update we provided price targets at which to accumulate as well as buy positions.

In the long run it may not make a difference whether you buy in January, now or at a lower price. However, it can make a difference for juniors. Lets say something is at 80c and you think it can go to $2.00 or $2.25. Your potential return becomes much larger if you can buy that position at 65c or even 70c. Last week we said: "If Gold and gold stocks correct here it may be one of your last chances to buy this sector at truly great prices". That could be the case for the next few

months.

Not a subscriber? Now is the time to get serious about this sector. Do not wait for the sector to breakout and be forced to buying stuff that is already moved 100%.

Learn More About & Subscribe to Our Service

You nearly always read the trends and support and resistance extremely well. Please keep us posted if or when the outlook seems to change. which you always do of course. TDG is the most valuable resource for understanding what is possible to understand about the PMs.

I appreciate your service and have some concept of the work that goes into it. Your stock picking is excellent.

Thanks for being a good stock picker and an excellent chartist.

I have been a subscriber since late last year and just wanted to say thanks. You are the best analyst for gold stocks that I have found. (And I have been around for quite a while : ) )

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. - Dr.

Jeffrey Kern, SkiGoldStocks.com

Learn More About & Subscribe to Our Service

Thanks for reading. I wish you all great health and prosperity in 2018!

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that

can cause results and outcomes to differ materially from those discussed herein. Novo Resources has contracted TheDailyGold.com for marketing purposes.

|