|

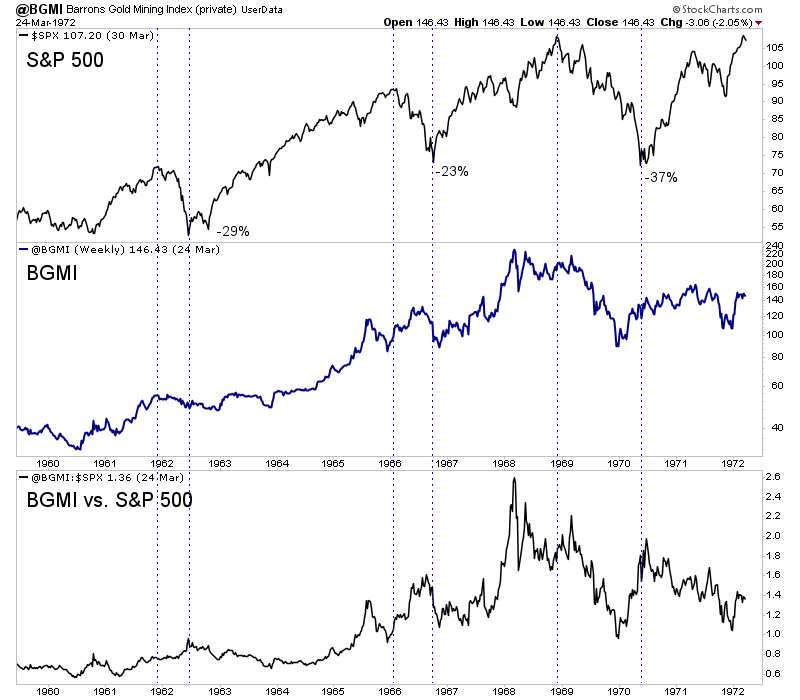

Chart 1: Gold Stocks & S&P 500 in 1960s

We plot the S&P 500, BGMI and then a ratio of BGMI to S&P 500.

Readers should first read our editorial, then look at this chart.

There was a strong negative correlation between stocks and precious metals for the majority of the 1970s. The 1960s were different. The correlation between the two was mostly positive. However, gold stocks strongly outperformed from 1960 to 1968 and especially from the end of 1963 to 1968. The mid 1960s is when inflation and bond yields began unabated rises to higher highs in the years ahead. Note how gold stocks performed during the three bear markets in the 1960s. They outperformed

during the first two and then they led the last one.

Early Saturday evening, we published TDG #556, a 25-page update which in my opinion was one of the most actionable updates we've published in recent months.

The update included several pages of charts and comments on how the present situation with gold/gold stocks, inflation, stock market, bond yields relates to the past.

We also noted something new in how gold stocks compare to 3 other markets which recovered from mega bear markets. Two of those three markets made a false new low which proved to be the second best buying opportunity (aside from the bear market bottom). So if the HUI, XAU and some other indices go below their December 2016 lows, it is not a breakdown but a tremendous buying opportunity.

Finally, we provided updated strong buy targets for a number of our favorite companies.

After a rough few weeks, there is tremendous value to be found in a number of juniors, including some of our favorites.

One of our favorites has an enterprise value that is below US $15 Million. Should Gold reach $1550, we think the market cap of that stock could reach $75 Million. Another one of our favorites has a current enterprise value of US ~$21 Million. The company has a small high grade resource with room to grow. They are currently drilling some of their highest potential targets. A few weeks ago we noted that even if they only grow their resource marginally, but if Gold breaksout and the stock is

valued as it was at the 2016 top then its market cap would reach $75-$80 Million.

These are the prices and values from which you can make 3x-5x your money or even more. If you wait and chase things higher, you can still make a lot but your returns won't be as good.

Learn More About & Subscribe to Our Service

You nearly always read the trends and support and resistance extremely well. Please keep us posted if or when the outlook seems to change. which you always do of course. TDG is the most valuable resource for understanding what is possible to understand about the PMs.

I appreciate your service and have some concept of the work that goes into it. Your stock picking is excellent.

Thanks for being a good stock picker and an excellent chartist.

I have been a subscriber since late last year and just wanted to say thanks. You are the best analyst for gold stocks that I have found. (And I have been around for quite a while : ) )

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. - Dr.

Jeffrey Kern, SkiGoldStocks.com

Learn More About & Subscribe to Our Service

Thanks for reading. I wish you all great health and prosperity in 2018!

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that

can cause results and outcomes to differ materially from those discussed herein. Novo Resources has contracted TheDailyGold.com for marketing purposes.

|