|

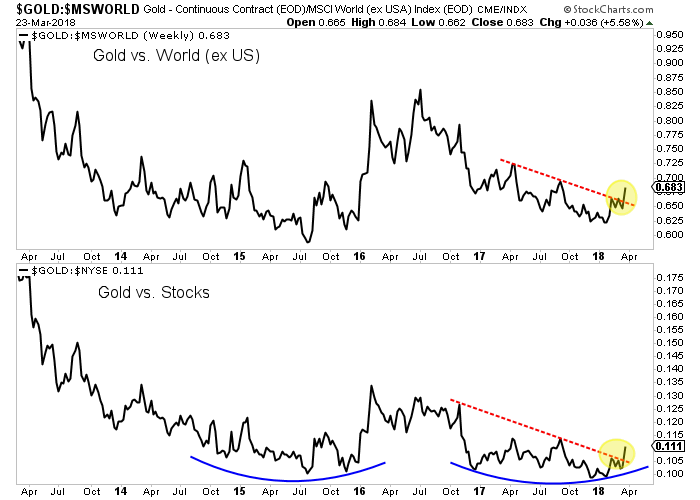

Chart 1: Gold vs. Stocks

Here we plot weekly line charts of Gold/Global Equities (ex US) and Gold/US Stocks. We use the Morgan Stanley World Index and the NYSE, which is a larger and broader index than the S&P 500.

Gold has broken its downtrend against Stocks. The next key is for these ratios to rise above their 2017 highs. Will these ratios back and fill or will they continue to rise over the next few weeks?

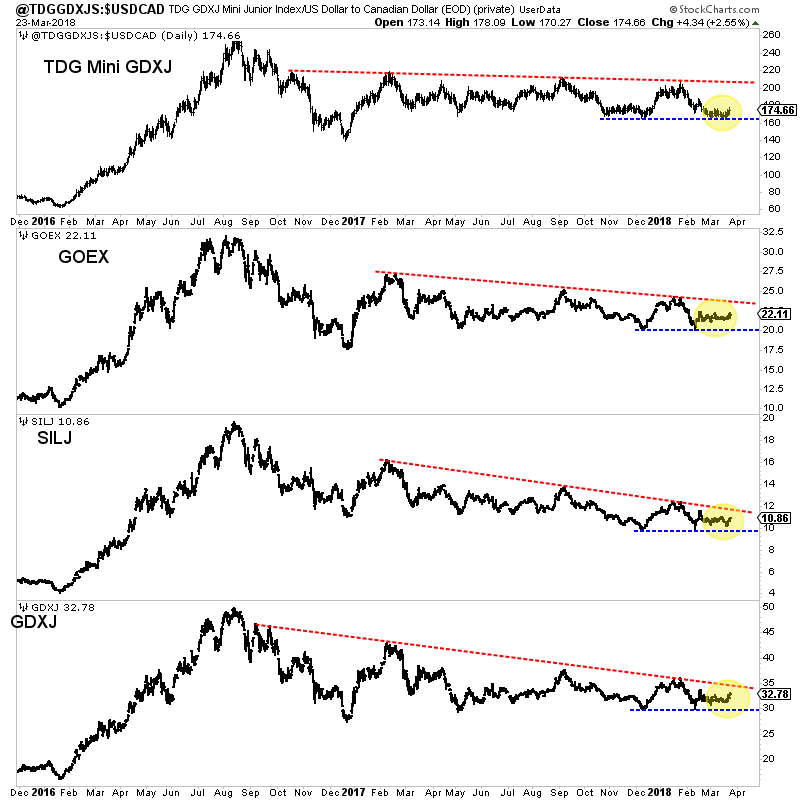

Chart 1: Juniors Setting up for Break

We plot daily bar charts of various junior ETFs including our own mini-GDXJ. Support and resistance are pinching in and eventually these charts will break up or down.

Until days ago, I figured (being conservative) these charts could break support before rebounding strongly towards resistance. Now the odds favor a break to the upside. Note how my mini-index is lagging a bit and could break to the upside only after GDXJ and the ETFs.

Sunday morning we published TDG #562, a 29-page update which covers our technical outlook for the sector, the positive developments and the questions still to be answered in the days and weeks ahead.

One key indicator is the percentage of stocks (within our 50 stock junior basket) that closed above the 200-dma. Over the past year this figure has never surpassed 51%. Friday it was 48%. So a move well above 51% would be very bullish for the sector.

This update also included intro coverage of two juniors that could have 10-bagger potential if they execute and Gold enters a real bull market. We would consider these for 3% positions. One is backed by a prominent royalty company while the other is dirt cheap with most risk being out of the stock.

Over the past few weeks we've put cash to work and accumulated several positions. Even though we were cautious on the sector, we felt the downside was so minimal that the bigger risk was not buying. Interestingly, not that many juniors we follow are too overbought. You can still accumulate at reasonable prices. Eventually that won't be the case.

For only $149, you can subscribe and get access to our top picks and biggest holdings. And you can accumulate them at reasonable prices before Gold has a major breakout. Now is the time to be looking and accumulating as many juniors are sold out and have little downside left in price.

Subscribe to our service and find out which juniors are great values and have massive potential over the next 12-18 months. (And we answer subscriber questions).

Subscribe for Only $149

As always, thank you for your hard work and disciplined insight. It's been very rewarding being a member of TDG Premium

You nearly always read the trends and support and resistance extremely well. Please keep us posted if or when the outlook seems to change. which you always do of course. TDG is the most valuable resource for understanding what is possible to understand about the PMs.

I appreciate your service and have some concept of the work that goes into it. Your stock picking is excellent.

Thanks for being a good stock picker and an excellent chartist.

I have been a subscriber since late last year and just wanted to say thanks. You are the best analyst for gold stocks that I have found. (And I have been around for quite a while : ) )

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. - Dr.

Jeffrey Kern, SkiGoldStocks.com

Learn More About & Subscribe to Our Service

Thanks for reading. I wish you all great health and prosperity in 2018!

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that

can cause results and outcomes to differ materially from those discussed herein. Novo Resources has contracted TheDailyGold.com for marketing purposes.

|