|

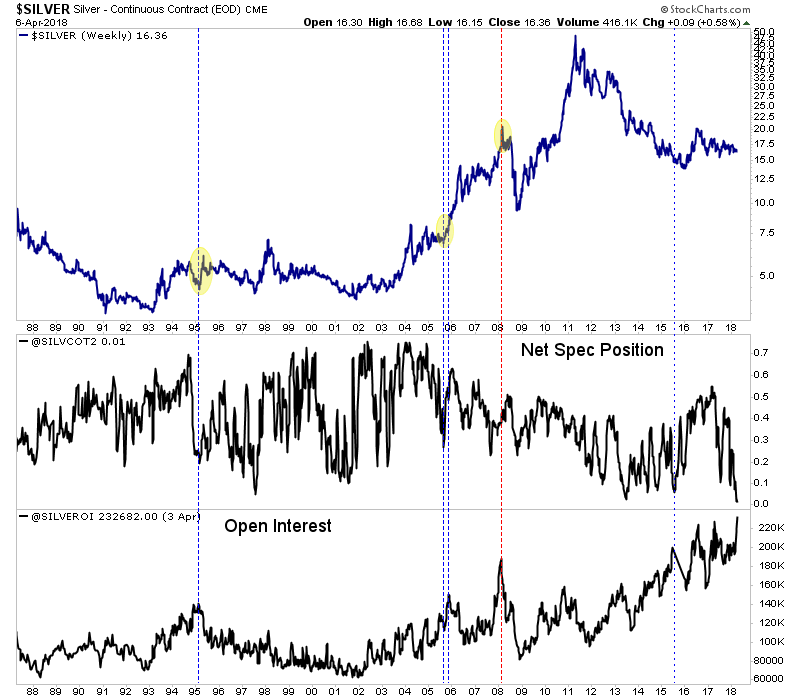

Chart 1: Silver CoT

We plot the net speculative position of Silver (against Open Interest) and we plot Open Interest.

The net spec pos two weeks ago was 1.7%, an all time low. Now it's even lower at 1.1% and OI is at an all time high. We highlight what happened at other points when the net spec pos was very low and OI was very high. We highlighted 2008 because OI spiked then.

In short, this is a powerful and bullish setup for Silver but it does not necessarily indicate an immediate sharp rebound or the start of a bull run. Look at 2015. We nearly had the same thing as we do now (although not quite as bullish). It took 4 months before Silver made a huge rebound.

Saturday evening we published and emailed TDG #564, a 29-page update, which I think is one of our most useful and valuable updates in recent weeks. The update included a report on one of our favorite Silver companies, a good amount of Q&A and we mentioned the 3 key developments (for precious metals) over the last week.

One of the key developments is the Silver CoT which we already mentioned. Its not only the record low net spec position but also the record high in open interest. This is very bullish for Silver but again, I don't know if it means Silver rockets higher immediately or in a few months.

One thing I do know is you need to be positioned in silver stocks now rather than later. We own a handful and all but one are trending higher. One of our favorites is the one we reported on in the update. It is cashed up, has a tight structure, low retail float, strong people and is poised to benefit should Silver make a move. We project it has roughly 250% upside from here should Silver reach $27-$28.

For only $149, you can subscribe and get access to our top picks and biggest holdings. And you can accumulate them at reasonable prices before Gold has a major breakout. Now is the time to be looking and accumulating as many juniors are sold out and have little downside left in price.

Subscribe to our service and find out which juniors are great values and have massive potential over the next 12-18 months. (And we answer subscriber questions).

Subscribe for Only $149

As always, thank you for your hard work and disciplined insight. It's been very rewarding being a member of TDG Premium

You nearly always read the trends and support and resistance extremely well. Please keep us posted if or when the outlook seems to change. which you always do of course. TDG is the most valuable resource for understanding what is possible to understand about the PMs.

I appreciate your service and have some concept of the work that goes into it. Your stock picking is excellent.

Thanks for being a good stock picker and an excellent chartist.

I have been a subscriber since late last year and just wanted to say thanks. You are the best analyst for gold stocks that I have found. (And I have been around for quite a while : ) )

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. - Dr.

Jeffrey Kern, SkiGoldStocks.com

Learn More About & Subscribe to Our Service

Thanks for reading. I wish you all great health and prosperity in 2018!

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that

can cause results and outcomes to differ materially from those discussed herein. Novo Resources has contracted TheDailyGold.com for marketing purposes.

|