|

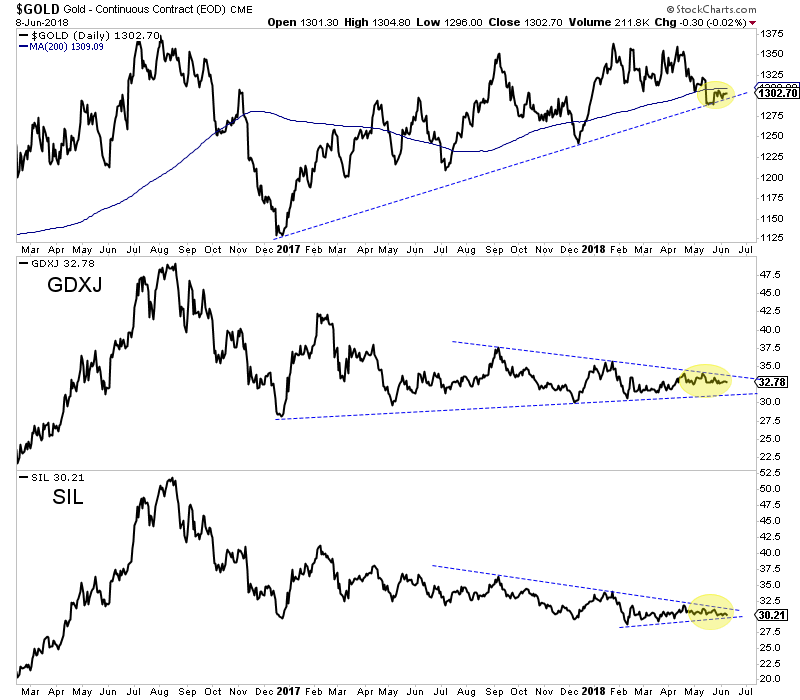

Chart 1: Gold & GDXJ, SIL

We plot Gold along with GDXJ (juniors) and SIL (silver stocks).

Gold closed the week at $1303. Its between support and resistance right now. A post-Fed selloff could take Gold down to around $1260 before a rally. Meanwhile, GDXJ and SIL are very close to a break.

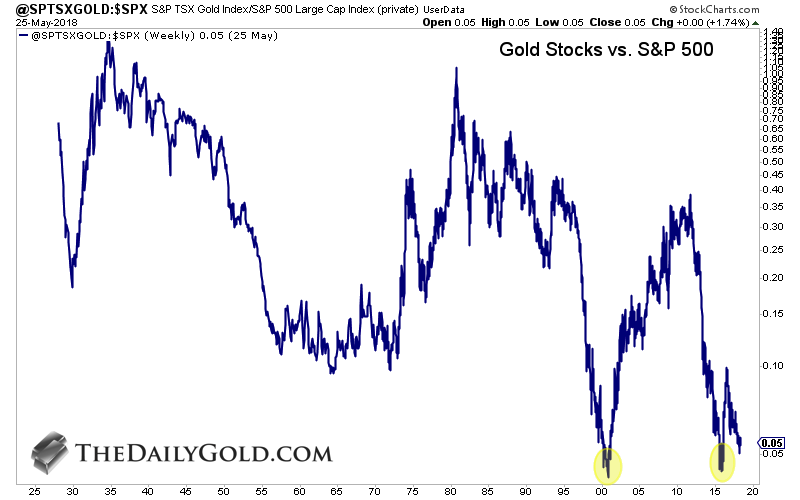

Chart 2: Gold Stocks vs. S&P 500

This is a historical look at the S&P TSX Gold Index vs. the S&P 500.

Gold Stocks are probably in the 98th percentile as far as historical value relative to the stock market. This ratio appears to be forming the second leg of a monster double bottom. Gold stocks are poised to outperform the stock market over the years and decades ahead. Consider how much they outperformed from 1958 to 1980? Or even from 1958 to 2011? This outperformance will be set in motion once the Fed is done with their rate hikes.

TheDailyGold Premium #573

|

This 24-page update was published and emailed to subscribers late Saturday night.

In this update we covered subscriber Q&A, the scenarios post-Fed meeting this week as well as a few companies that can add value without the tailwind of the Gold price. Both companies could be trading higher 12 months from now even if Gold is at $1200/oz.

We bought an initial position in one of the companies and intend to increase that position soon enough. The company has healthy technicals and has a reasonable chance to add significant value this year and next year. In this type of market, the stock could probably double in a year. If its not acquired and Gold begins a bull then it could have 4x-5x potential. Oh and by the way, its had insider buying recently!

Because there is little chance of a gold breakout and therefore no tailwind, we have to be cautious about the companies we own. Can they move without metals prices? The answer depends on if they can make a discovery or add value to an existing discovery. If the answer is no, then we don't want to own that company.

This is a time to be nimble. Let winners run but trim them when they become too hot. Cut losses quickly and dump laggards. Focus on companies that can add significant value over the coming quarters.

Consider a subscription as we can help you follow the stocks that have a chance to make gains into 2019 and beyond.

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I

respect his integrity. - Dr. Jeffrey Kern, SkiGoldStocks.com

For only $149, you can subscribe and get access to our top picks and biggest holdings. And you can accumulate them at reasonable prices before Gold has a major breakout.

Subscribe to our service and find out which juniors are great values and have massive potential over the next 12-18 months. (And we answer subscriber questions).

Subscribe for Only $149

As always, thank you for your hard work and disciplined insight. It's been very rewarding being a member of TDG Premium

You nearly always read the trends and support and resistance extremely well. Please keep us posted if or when the outlook seems to change. which you always do of course. TDG is the most valuable resource for understanding what is possible to understand about the PMs.

I appreciate your service and have some concept of the work that goes into it. Your stock picking is excellent.

Thanks for being a good stock picker and an excellent chartist.

I have been a subscriber since late last year and just wanted to say thanks. You are the best analyst for gold stocks that I have found. (And I have been around for quite a while : ) )

Learn More About & Subscribe to Our Service

Thanks for reading. I wish you all great health and prosperity in 2018!

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that

can cause results and outcomes to differ materially from those discussed herein. Novo Resources has contracted TheDailyGold.com for marketing purposes.

|