|

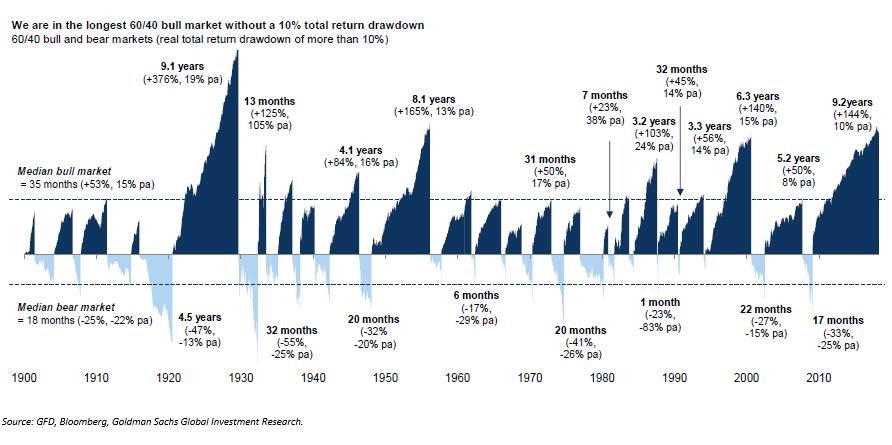

Chart 1: 60/40 Portfolio Losses

This chart shows the bull markets and +10% losses from a traditional 60/40 portfolio. 60% in stocks, 40% in bonds.

The portfolio is overdue for a +10% decline. When that happens it should benefit Gold.

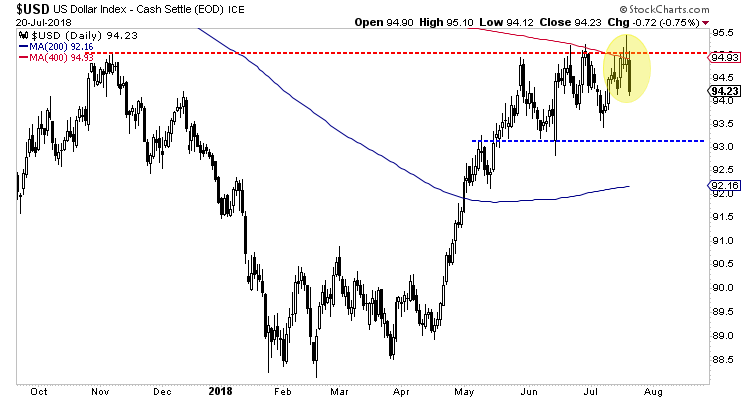

Chart 2: US$ Daily Candle Chart

Here is the daily candle chart of the US$ index which formed another bearish reversal at major resistance at 95.

Ultimately, the US$ could go much higher if it surpasses that resistance at 95-96. Its currently correcting and consolidating recent gains. It has support at 93.00 and the rising 200-dma at 92.16. However, over the coming days and weeks, the trend looks to be lower and that should favor Gold and precious metals for the duration of the summer.

TheDailyGold Premium #579

|

The 21-page update was published and emailed to subscribers late Saturday night.

In the update we cover our expectation for a sustained rebound in Gold over the weeks ahead. The upside target resistance is at $1260 and $1274. My guess is $1265 is a good target but Gold could poke above that for a day or two. With the monthly support at $1200-$1210 and the current oversold condition, that recent low could hold for the duration of the summer.

Sentiment finally reached a true extreme with respect to the CoT. Gold's CoT, which was at 0% at the December 2015 low, hit a 2-year low at ~13%. (The net spec position was 13% of open interest). If the CoT were taken Thursday, the reading was likely around 10%. Within the context of a downtrend, a sub 15% reading is extreme.

A short opportunity may come after this rebound. We'll see.

We are holding only 7 stocks as we started raising cash in April and May when the sector failed to breakout. We are quite confident in the ability of each of our companies and their ability to add value via discovery or another route over the coming months.

One of our holdings has a market cap below US $30 Million and a major owns nearly 20% of it. It will announce drill results over the next few weeks. The stock has been very strong in recent days. Recent buying suggests they could be onto something. If the market thinks they have a real discovery here, the stock could easily double given its extremely tight float and low market cap.

Consider a subscription as we can help you navigate what lies ahead for the sector and help you position in the stocks that can make big gains when the Federal Reserve is done hiking rates. Subscribe and give us your list of stocks and we will give our opinion, buy, sell or hold.

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I

respect his integrity. - Dr. Jeffrey Kern, SkiGoldStocks.com

I follow your work and it's very impressive -- am considering subscribing even though I focus on futures and macro more than individual equities. You are a refreshing voice in a space full of doom-and-gloomers, perma-bulls, and precious metals salesmen.

My 6 month renewal is due once again. Your work continues to be outstanding and I want to make sure there are no disruptions in the service.

You nearly always read the trends and support and resistance extremely well. Please keep us posted if or when the outlook seems to change. which you always do of course. TDG is the most valuable resource for understanding what is possible to understand about the PMs.

Subscribe to our service for only $149 and find out which juniors are great values and have massive potential over the next 12-18 months. (And we answer subscriber questions).

Subscribe for Only $149

Thanks for reading. I wish you all great health and prosperity in the second half of 2018 and beyond!

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that

can cause results and outcomes to differ materially from those discussed herein. Novo Resources has contracted TheDailyGold.com for marketing purposes.

|