|

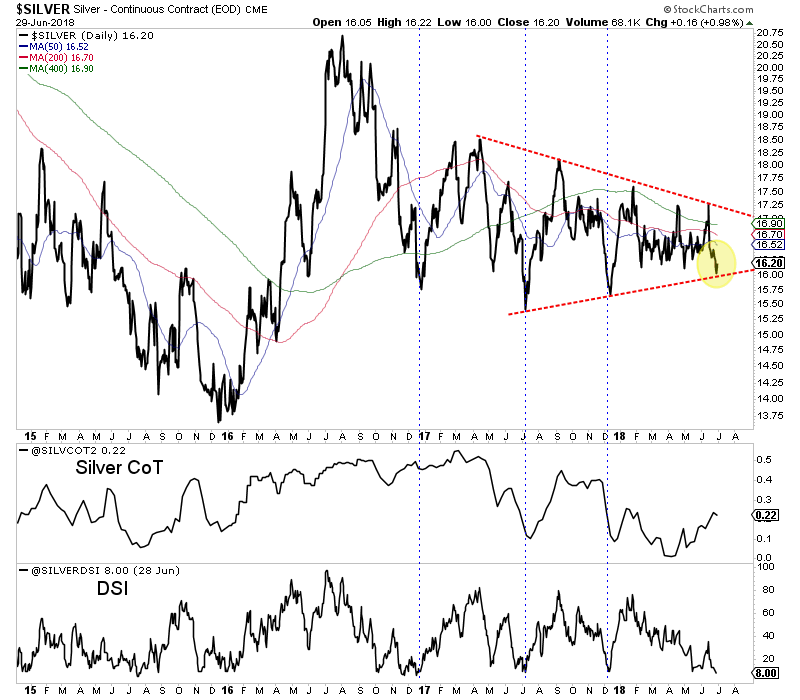

Chart 1: Silver Consolidation is Approaching a Break

The sector is likely to rally in July and that includes Silver. However, the prognosis for Silver is tenuous as it tries to hold triangle support. Its already below all of the major moving averages.

The three vertical lines point to the last 3 major lows (for Silver and the sector). The big rallies were driven by sentiment unwinds and the dollar declining significantly. The problem for Silver (and Gold) is that the dollar trend is likely higher.

TheDailyGold Premium #576

|

This 28-page update was published and emailed to subscribers Saturday evening. Perhaps once a month we are really excited about what we publish because we know its more substantial and valuable than other upsides. This was exactly the case with this update.

We cover the short-term and medium term outlook for the sector as well as the prognosis for the companies in our portfolio. We have been raising cash over the past few months and probably will raise more assuming the sector rallies here.

Its important to note, there still are bullish opportunities out there and companies are being rewarded for making discoveries or adding value. Our last two buys are up nicely and we actually bought a new position on Friday.

I'll repost what I wrote two weeks ago:

Because there is little chance of a gold breakout and therefore no tailwind, we have to be cautious about the companies we own. Can they move without metals prices? The answer depends on if they can make a discovery or add value to an existing discovery. If the answer is no, then we don't want to own that company.

This is a time to be nimble. Let winners run but trim them when they become too hot. Cut losses quickly and dump laggards. Focus on companies that can add significant value over the coming quarters. Raise cash at times and prepare for the better opportunities coming in 6-9 months.

Consider a subscription as we can help you navigate what lies ahead for the sector and help you position in the stocks that can make big gains when the Federal Reserve is done hiking rates.

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I

respect his integrity. - Dr. Jeffrey Kern, SkiGoldStocks.com

I follow your work and it's very impressive -- am considering subscribing even though I focus on futures and macro more than individual equities. You are a refreshing voice in a space full of doom-and-gloomers, perma-bulls, and precious metals salesmen.

My 6 month renewal is due once again. Your work continues to be outstanding and I want to make sure there are no disruptions in the service.

You nearly always read the trends and support and resistance extremely well. Please keep us posted if or when the outlook seems to change. which you always do of course. TDG is the most valuable resource for understanding what is possible to understand about the PMs.

Subscribe to our service for only $149 and find out which juniors are great values and have massive potential over the next 12-18 months. (And we answer subscriber questions).

Subscribe for Only $149

Thanks for reading. I wish you all great health and prosperity in the second half of 2018 and beyond!

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that

can cause results and outcomes to differ materially from those discussed herein. Novo Resources has contracted TheDailyGold.com for marketing purposes.

|