|

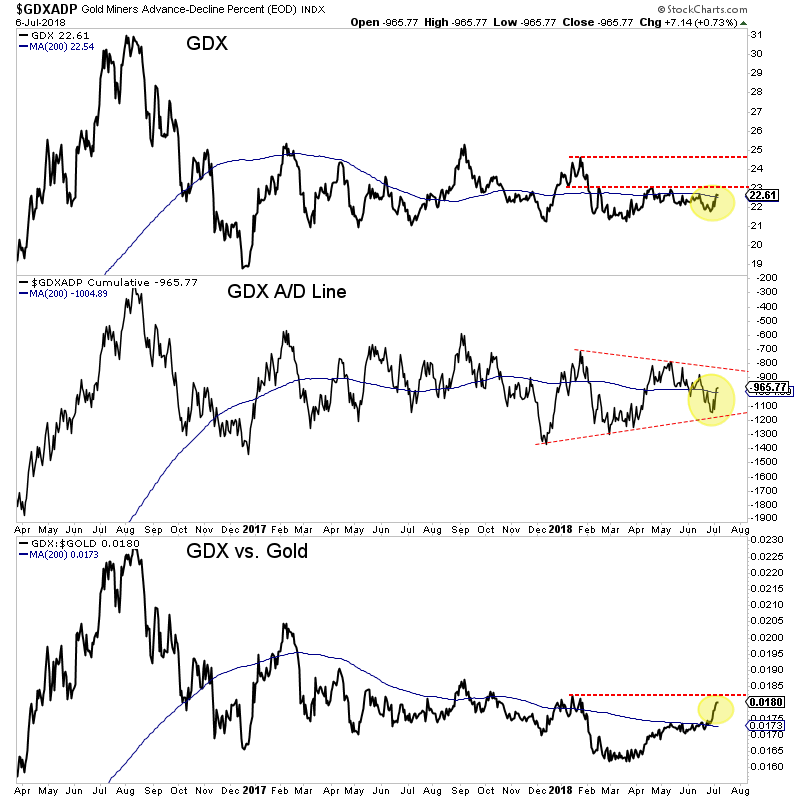

Chart 1: GDX, GDX A/D Line & GDX/Gold Ratio

Here we plot GDX along with its advance decline line (the best breadth indicator) and GDX vs. Gold.

The GDX/Gold ratio implies GDX has a chance to reach $24.50. However, the GDX A/D line, which is one of the best leading indicators, does not imply the same. It would say GDX is where it should be. If the A/D line were higher and breaking out of the triangle, it would give a strong argument (along with strength in GDX/Gold) that GDX would reach $24.50.

So the GDX/Gold strength is encouraging but much more needs to be proven for it to be encouraging beyond July and part of August.

TheDailyGold Premium #577

|

This 24-page update was published and emailed to subscribers early Sunday morning. The summer rally that we foresaw is now underway.

Moving forward there are a few key issues for the sector (which we covered in the update).

The first is the implications of the strength in the gold stocks relative to Gold. Its certainly a short-term positive but as the chart above shows, its not confirmed by stronger breadth (greater participation). The A/D line is kind of "meh." Ultimately, if Gold fails at strong resistance at $1300-$1310, then miners as a group are not going to break above key resistance.

The second issue is the dollar. Beyond this summer rally I have a bearish outlook. If the dollar cannot surpass major resistance at 96 then that would throw off my outlook. (This question will likely be answered not in a few weeks but in a few months at least).

With all that said, its important to note there still are bullish opportunities out there and companies are being rewarded for making discoveries or adding value.

Two of our last 3 buys (which occurred in the last 5 weeks) are up 25% and 16% already. One is a producer that is having tremendous exploration success while the other is a stock we added to after it corrected 30%. It is an exploration stock that could go much higher if summer drilling hits again.

Our most recent buy (June 29) is up 1%. Simply put, we think the stock definitely moves higher over the next few months as long as Gold holds above $1200.

Its a tough and tricky environment but its also a stock pickers environment. I love that because it rewards you for doing the research and uncovering stocks that can perform even without much help from metals prices.

Consider a subscription as we can help you navigate what lies ahead for the sector and help you position in the stocks that can make big gains when the Federal Reserve is done hiking rates.

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I

respect his integrity. - Dr. Jeffrey Kern, SkiGoldStocks.com

I follow your work and it's very impressive -- am considering subscribing even though I focus on futures and macro more than individual equities. You are a refreshing voice in a space full of doom-and-gloomers, perma-bulls, and precious metals salesmen.

My 6 month renewal is due once again. Your work continues to be outstanding and I want to make sure there are no disruptions in the service.

You nearly always read the trends and support and resistance extremely well. Please keep us posted if or when the outlook seems to change. which you always do of course. TDG is the most valuable resource for understanding what is possible to understand about the PMs.

Subscribe to our service for only $149 and find out which juniors are great values and have massive potential over the next 12-18 months. (And we answer subscriber questions).

Subscribe for Only $149

Thanks for reading. I wish you all great health and prosperity in the second half of 2018 and beyond!

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that

can cause results and outcomes to differ materially from those discussed herein. Novo Resources has contracted TheDailyGold.com for marketing purposes.

|