|

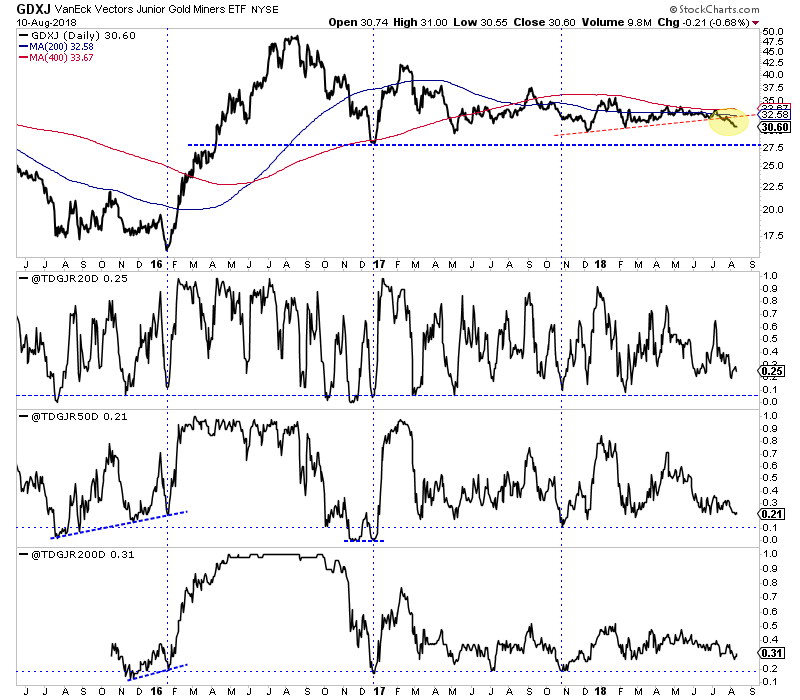

Chart 1: GDXJ w/ Breadth Indicators

This image plots GDXJ along with breadth indicators based on a 55 stock basket of junior stocks. We plot the percentage of the basket that closed above their 20-dma, 50-dma and 200-dma.

Those three figures come in at 25%, 21% and 31%. As you can see, they are a little oversold but are not close to extremes yet. Maybe if GDXJ declines 9% to that strong support near $28, then the breadth indicators would approach extremes.

TheDailyGold Premium #582

|

The 24-page update was published and emailed to subscribers late Saturday night.

The two takeaways from the update were Gold looks increasingly ready to rally while the gold stocks made a technical breakdown and are not yet oversold.

Gold continues to hold $1200-$1210 despite an upside surge and breakout in the US$. That and the net spec position falling to only 5.6% of open interest (it was 0.1% in late 2015) bode well for a Gold rebound. If Gold can takeout $1230-$1235 then it should reach $1260.

Meanwhile, the gold stocks brokedown. The HUI closed at a 2.5 year low while GDX closed at an 18-month low. A market that makes that kind of a breakdown can threaten to decline more before it has an oversold rally. Moreover, we noted the breadth indicators for GDXJ above. For GDX, its bullish percentage index is 37%. It was 7% at the December 2016 low and 17% at the July 2017 low.

So while Gold is oversold and stabilizing, the gold stocks are not. They could drop more before they sustain a rally.

We discussed our targets for selling our JDST and DUST positions which obviously are performing well. We still sense a lot of upside in the coming months. New subscribers have a chance to make money as the sector declines and then load up on juniors that have a chance to be 5 and 10 baggers after the bottom sometime next year.

Consider a subscription as we can help you navigate what lies ahead for the sector and help you position in the stocks that can make big gains when the Federal Reserve is done hiking rates. Subscribe and give us your list of stocks and we will give our opinion, buy, sell or hold.

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I

respect his integrity. - Dr. Jeffrey Kern, SkiGoldStocks.com

I follow your work and it's very impressive -- am considering subscribing even though I focus on futures and macro more than individual equities. You are a refreshing voice in a space full of doom-and-gloomers, perma-bulls, and precious metals salesmen.

My 6 month renewal is due once again. Your work continues to be outstanding and I want to make sure there are no disruptions in the service.

You nearly always read the trends and support and resistance extremely well. Please keep us posted if or when the outlook seems to change. which you always do of course. TDG is the most valuable resource for understanding what is possible to understand about the PMs.

Subscribe to our service for only $149 and find out which juniors are great values and have massive potential over the next 12-18 months. (And we answer subscriber questions).

Subscribe for Only $149

Thanks for reading. I wish you all great health and prosperity in the second half of 2018 and beyond!

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that

can cause results and outcomes to differ materially from those discussed herein. Novo Resources has contracted TheDailyGold.com for marketing purposes.

|