|

Chart 1: Stock Market Breadth Improvement

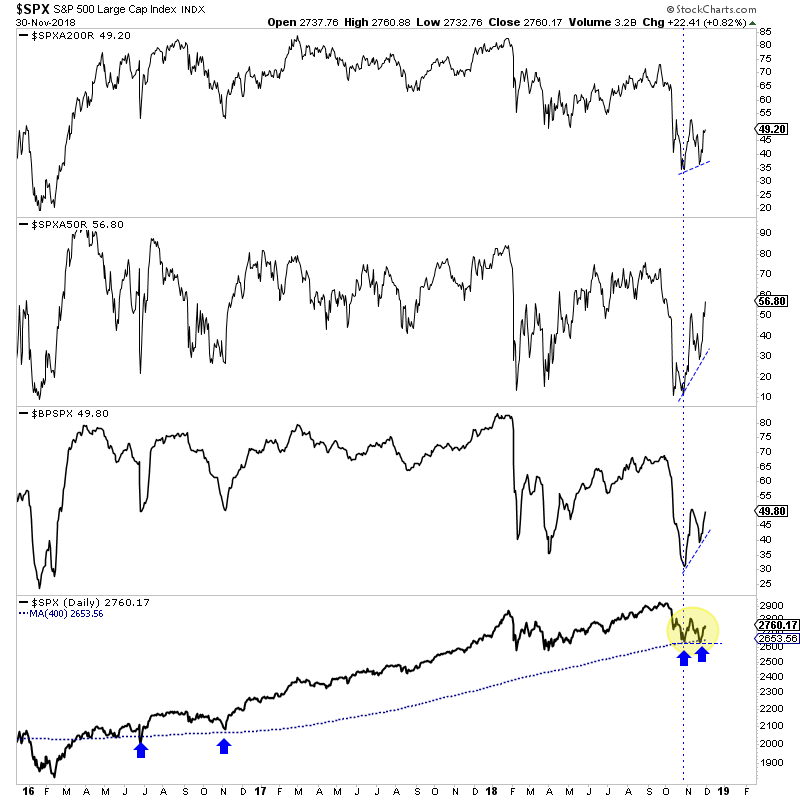

In the chart below we plot some breadth indicators along with the S&P and its 400-day moving average. The S&P 500 recently formed a bit of a double bottom as it bounced off the moving average twice.

From top to bottom we plot the percentage of S&P 500 stocks that are trading above the 200-dma, 50-dma and then the bullish percentage index.

The S&P 500 formed a double bottom but the second low was slightly below the first. However, these breadth indicators formed a strong positive divergence. In the big picture, breadth is weakening and a problem. But over the near-term it has strengthened and that suggests this double bottom should hold for at least several months.

TheDailyGold Premium #598

|

We published TDG #598, a 23-page update Sunday morning.

Gold bugs are getting excited at the prospect of the Fed stopping hikes and then Gold rallying big. But we aren't there yet. That optimism is putting the cart before the horse.

The gold stocks remain very weak and breadth is terrible. They are too weak to have a big rally right now but perhaps too oversold that they won't dump lower immediately. Or could they?

A stronger stock market leads to stronger Fed rate hike expectations and that will pressure precious metals. So if the stock market just put in a bottom that will hold for a while it's hard to see precious metals taking off anytime soon.

That being said, many juniors that are very oversold could bounce back in January. I expect that from some of our holdings. Several of our holdings are trading at excellent buy prices.

This is a great time to subscribe because we are updating reports for our top holdings. So you can get an immediate update on these companies. And it's also a great time to be buying them. Not everything will bottom at the same time as Gold and GDX.

If the miners look like they will breakdown again and get close to it, we are prepared to profit from the downside just as we did in August.

Subscribe for Only $149

You are the man. Every time I hope you are wrong, you are for the most part right.

Man! I wish I would have signed up for your service last month. I think you could have saved me from the bloodbath in my account. I have liked your approach.

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I

respect his integrity. - Dr. Jeffrey Kern, SkiGoldStocks.com

I follow your work and it's very impressive -- am considering subscribing even though I focus on futures and macro more than individual equities. You are a refreshing voice in a space full of doom-and-gloomers, perma-bulls, and precious metals salesmen.

My 6 month renewal is due once again. Your work continues to be outstanding and I want to make sure there are no disruptions in the service.

You nearly always read the trends and support and resistance extremely well. Please keep us posted if or when the outlook seems to change. which you always do of course. TDG is the most valuable resource for understanding what is possible to understand about the PMs.

Subscribe to our service for only $149 and find out which juniors are great values and have massive potential over the next 12-18 months. (And we answer subscriber questions).

Subscribe for Only $149

Thanks for reading. I wish you all great health and prosperity!

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that

can cause results and outcomes to differ materially from those discussed herein. Novo Resources has contracted TheDailyGold.com for marketing purposes.

|