Chart 1: Silver Bear Analog

I didn't have enough time to include this in the premium update, unfortunately. This chart will be in the updated version of my book which I wil publish in the next month or so.

What do you think?

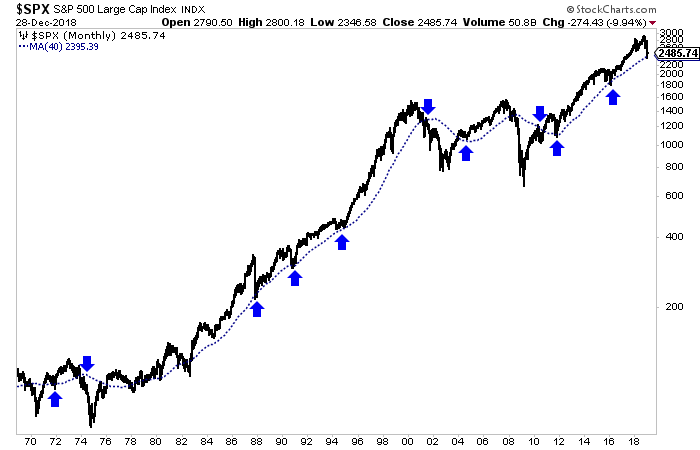

Chart 2: S&P 500 w/ 40-Month Moving Average

Chart 2: S&P 500 w/ 40-Month Moving Average

So the market rebounded from its 40-month moving average amid an extreme oversold condition. Some indicators were at decade extremes.

If we are headed for a real bear market then the S&P 500 will lose this moving average support before the end of 2019. The moving average is at 2395 while the S&P closed at 2486. It traded as low as 2347.

TheDailyGold Premium #602

|

We published TDG #602, a 23-page update Sunday morning.

This update included our thoughts on the sector as well as an intro report on a junior exploration company high on our watch list. This company is one that "ticks all of the boxes" but was expensive in 2017 and into 2018. So we ignored it until recently.

Technically the stock became extremely oversold but has built a base of support. It may grind out a new uptrend in 2019. We love the long-term risk/reward here as downside is limited and if the company can discover or define a deposit it likely moves much, much higher.

These are the situations we are looking for. Juniors with exciting potential but a backstop (some proven value). And in that category we want to see it trading well off its highs but building some kind of a base. We don't want to buy something that is in a sustained downtrend.

Regardless of what happens to the stock market and Gold in the months ahead, those types of situations give us a favorable risk/reward as these company's can move higher if it creates value. There aren't a ton of these out there but there are some.