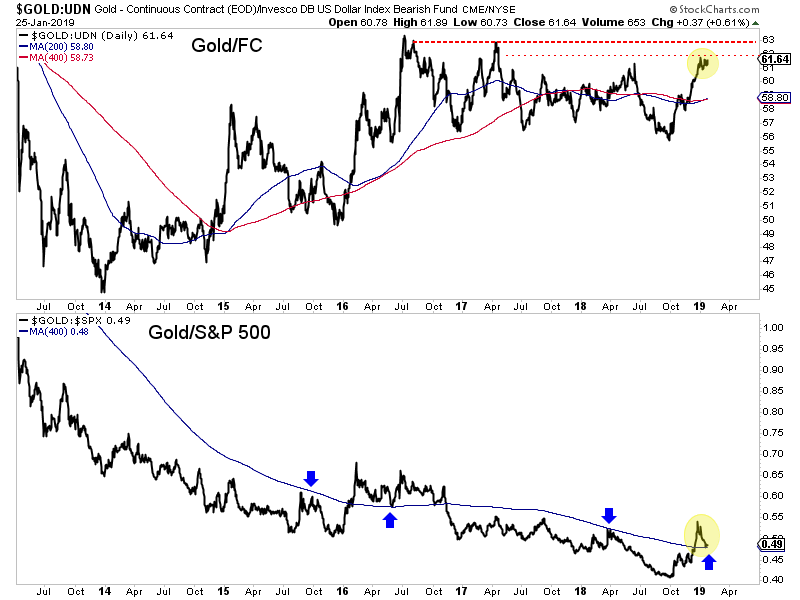

Chart 1: Gold/Foreign Currencies & Gold/S&P 500

If Gold/FC, which closed at 61.64 could close above 63 and Gold/S&P 500 could make a higher high then it would provide additional evidence in favor of a precious metals bull.

Both have made solid moves in recent months. Can they make another move higher in the next quarter?

TheDailyGold Premium #606

|

We published TDG #606 a smaller 16-page update. I caught a very bad cold while in Vancouver and have been sick for a week. Now I have laryngitis.

Friday was a nice pop for the sector but lets see if its sustainable. I just don't see this being the start of another run unless the Fed this week says its done hiking. Be wary of the overreaction to the Fed in either direction.

Right now, the key is to accumulate value and things that can perform without the Gold price. We have a few things in mind and just bought one. We have another position that we want to add too. These 2 stocks could be two of the strongest takeover targets this year.

Also, this is the time to make a watch list of things that could become much better buys later this year when the Fed, for sure, will probably be done.

Consider a subscription as we can keep you abreast of potential 5 and 10 baggers when the Fed does shift course.