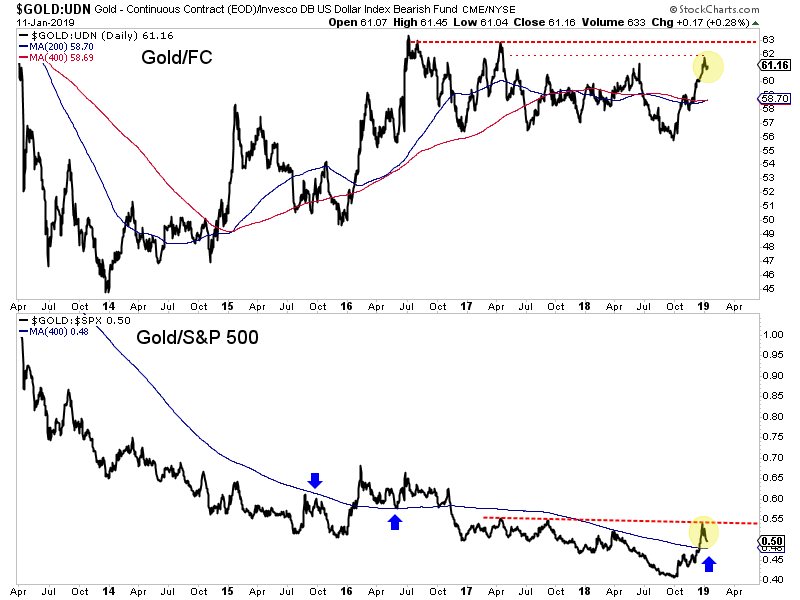

Chart 1: Gold vs. Currencies & Stocks

Here we plot Gold/FC and Gold/Stocks (S&P 500).

Numerous charts and stats for precious metals are coming up against bear market resistance. If they push through then we could assume precious metals are moving into a bull market.

Here are two more examples. If Gold/FC, which closed at 61, could test 63 and push above it, then it would be a significant breakout and a 6-year high. Meanwhile, if Gold/S&P can surge past 0.55 it would reach a +2 year high and mark a second higher high- something it failed to achieve in 2016.

TheDailyGold Premium #604

|