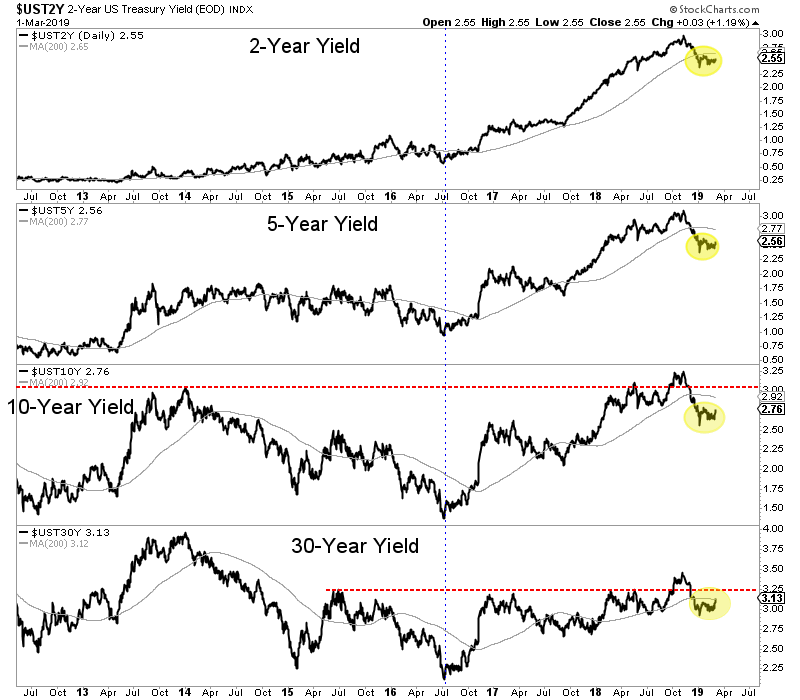

Chart 1: Bond Yields

We plot a number of bond yields in the chart below. Bond yields are turning higher and this is a headwind for Gold, initially.

The recent rally and the one in 2016 coincided with falling yields. As we can see, yields have made a low and the path of least resistance is higher. If longer-term yields start rising faster that's good for Gold because it signals rising inflation expectations. However if everything is rising together at the same pace that's not good for Gold. Higher yields in the short-term will lead the market to think the Fed could hike again.

TheDailyGold Premium #611

|

TDG #611, a 26-page update was published and emailed to subscribers early early Sunday AM.

Last week we anticipated a weak market into spring but we didn't expect such a vicious selloff so quickly. In any case, the path of least resistance is lower at least until the 200-dma's. We'll see how much of a rally that gives us and if recent encouraging breadth holds up.

In the meantime, we are going to beef up our company reports and try to report on as many companies as we can and not just everything we own. Last year after spring we didn't write as many company reports because we were bearish. This year we want to write as many as we can before the real move higher begins.

This week we covered a micro-cap company that is on our watch list and is something we probably will buy at somepoint in the months ahead. The good news for buyers is the stock currently has a warrant overhang that is preventing the stock from moving much higher. Based on a $1250 Gold price the stock could be a 4-bagger in 18 to 24 months. If Gold begins a bull market this year or next year the stock could be a 10-bagger.

Consider a subscription as we can keep you abreast of sector developments and get you invested in the companies with 3x, 5x and 10x potential.