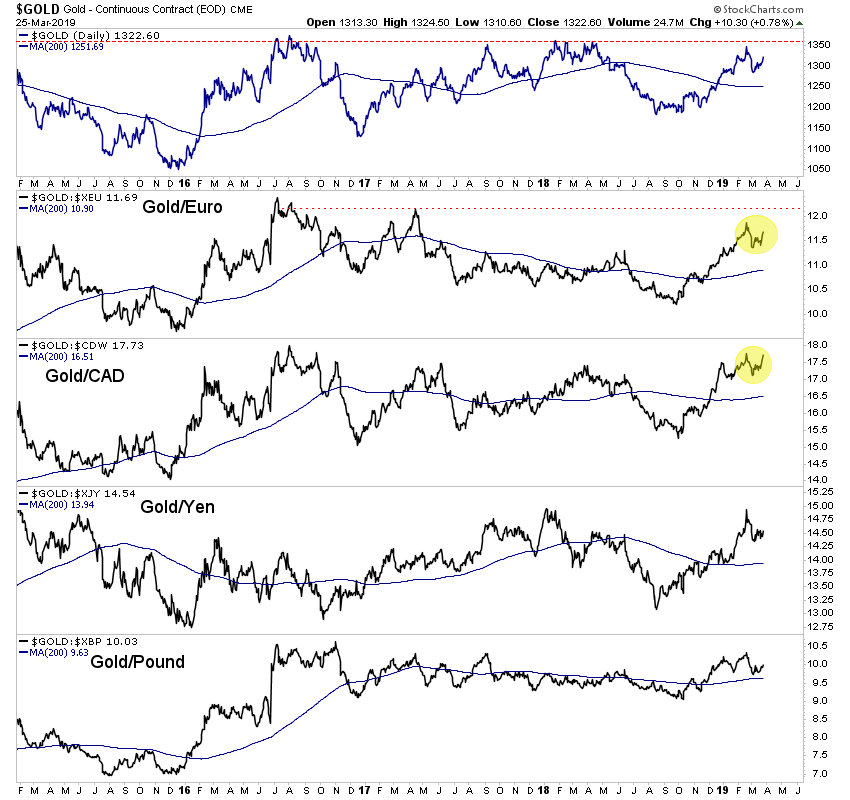

Chart 1: Gold vs. Currencies

We plot the Gold price in a number of currencies.

Gold/Euro is the key as the Euro comprises almost 60% of the dollar index. Gold is bullish against the various currencies.

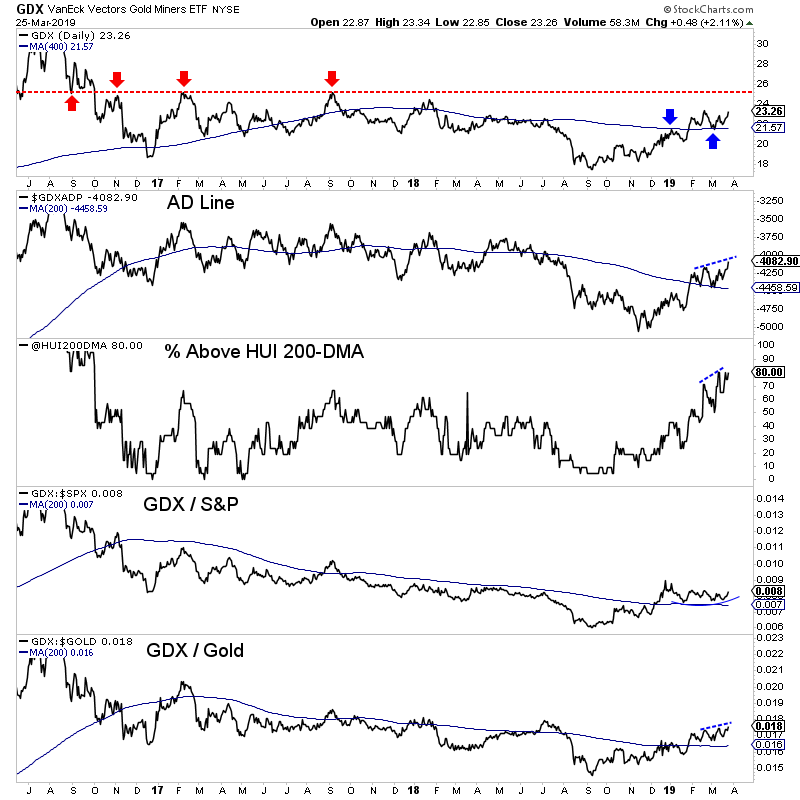

Chart 2: GDX w/ Indicators

Chart 2: GDX w/ Indicators

We plot GDX along with its AD Line, the percentage of HUI stocks above the 200-dma and then two ratios: GDX/S&P, GDX/Gold.

GDX this year failed at its 400-dma then went above it and successfully retested it a few weeks ago. Its only 1% from the February high. A 7% advance takes it to strong resistance at $25.

The A/D line has made a higher high already, and so too has GDX/Gold.

TheDailyGold Premium #614

|

TDG #614, a 26-page update was published and emailed to subscribers on Saturday night.

The update included a report on a company we think has a chance to become the next Mariana Resources, a company that was acquired after making a major discovery in Turkey a few years ago.

The sector is looking stronger now but there are plenty of stocks presenting great entry points.

One of our largest positions is a company that was a big winner in 2018. If you are looking for a safer junior, this is it. It just corrected 22% and has formed another higher low. How often can you buy a great stock at 20% off? We expect it to be acquired in the next 12-18 months.

Last week we noted that our favorite explorer will be drilling both its projects over the next 3-4 months. And they have the cash to follow up after the summer. At the sector top in 2016 these two projects had a combined value of US $200 Million. This company last week had an enterprise value of only US ~$20 Million. Now its closer to $23 Million as the stock appears to have put in a bottom.

We have another explorer with a project with huge potential and the stock is just coming off its low. We'll tease it more next week.

Consider a subscription as we can keep you abreast of sector developments and get you invested in the companies with 3x, 5x and 10x potential.