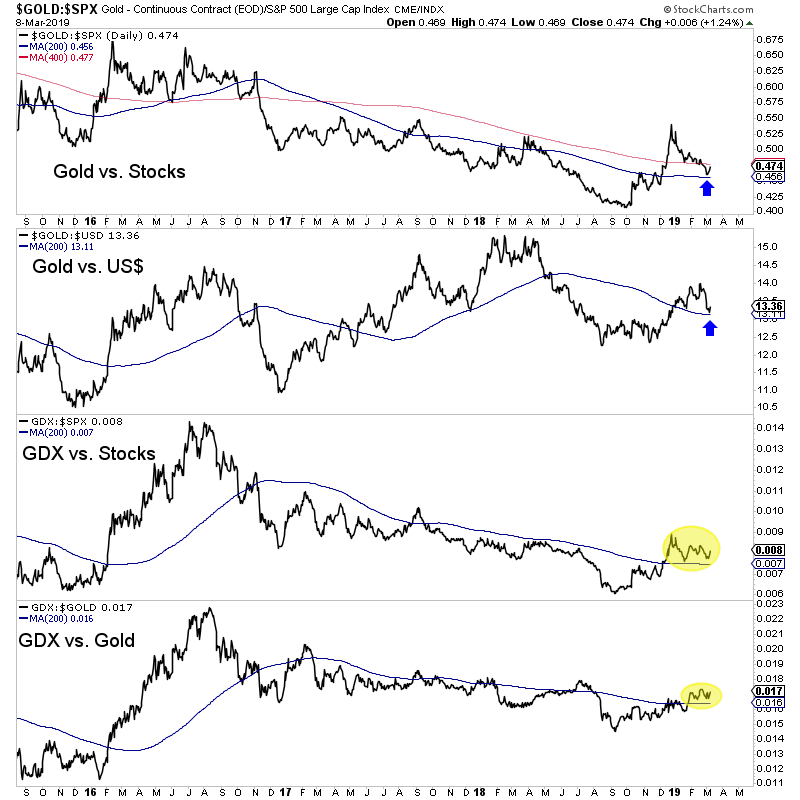

Chart 1: Gold Ratios

Here we plot several different Gold ratios. From top to bottom: Gold/Stocks, Gold/Dollar, GDX/Stocks, GDX/Gold.

In relative terms GDX is showing more strength than Gold. The two ratios at the bottom are the strongest. Gold/Stocks is the key one though. It needs to make a higher high for Gold to have any chance to breakout. Now if GDX/Stocks makes a higher high first, that could be considered a potential leading indicator for Gold/Stocks.

TheDailyGold Premium #612

|

TDG #612, a 28-page update was published and emailed to subscribers early Sunday AM.

We discussed the current bearish and bullish arguments for the sector. Ultimately, for a big breakout in the sector Gold and gold stocks do need to perform better against the stock market.

The company report within this update was on a company that has made some high grade discoveries and should have enough of a resource to become a producer that can generate up to 60K oz Au/yr. The company's enterprise value is roughly US $80 Million and the capex to be a small producer is minimal.

The question is how much more high grade can they find? If they are successful and can define a +1M oz Au resource then the company would likely have a 100K oz Au/yr mine on its hands and could be acquired.

Good management, good jurisdiction, good grade. The question is how much more of it can they find and that will determine the stock performance this year. The odds of a company like this finding more high grade is better than a company starting from ground zero.

Consider a subscription as we can keep you abreast of sector developments and get you invested in the companies with 3x, 5x and 10x potential.