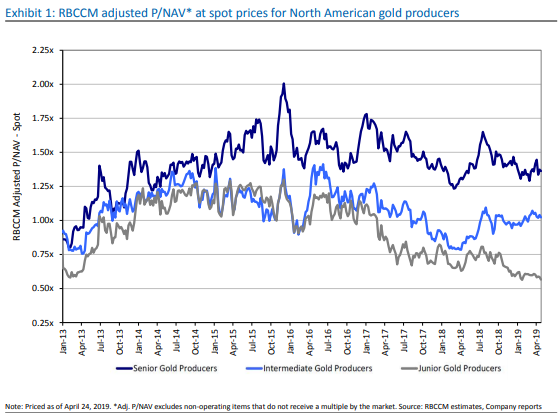

Chart 1: Price to NAV Valuations for Gold Producers

Junior producers are trading at a lower P to NAV valuation than in 2013 during the Gold crash. Junior producers are relatively more cheap than intermediate and senior producers.

TheDailyGold Premium #620

|

We published TDG #620, a 22-page update on Saturday night.

There was not much to tease from that update.

There is one exploration stock we are very close to buying. A few of our holdings are very cheap with most of the risk priced out. They will have important exploration coming up over the next few months.

In TDG #619 we covered two companies (we don't own) which share some similarities. Both are new companies following very impressive transactions. Both are trading at very good values and are quite oversold.

We are looking for value with exploration potential and catalysts within a few months. There are plenty of these to be found. Then you have to sift through and go with the absolute best of the bunch.

The sector is oversold now but broken. We want to see it get more oversold and then reach strong support levels. That's the time to be bullish again at least for a rebound. If the fundamentals align than the sector can rocket higher.

Consider a subscription as we can keep you abreast of sector developments and get you invested in the companies with 3x, 5x and 10x potential.