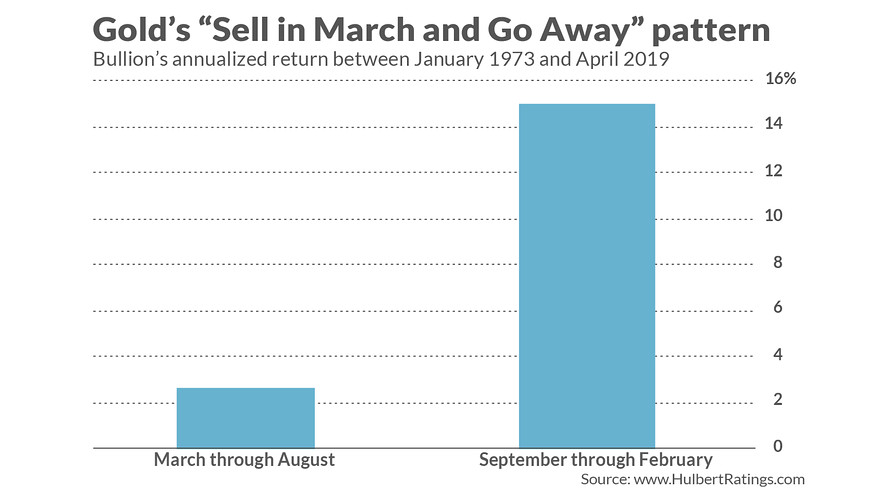

Chart 1: Gold Seasonality

I'm not big on seasonality as I've usually concluded that the trend of the market plays a much bigger role. That being said, this is hard to ignore. Moreover, given my bearish outlook on Gold for the next few months and the potential for a key low by the end of summer, this carries even more weight.

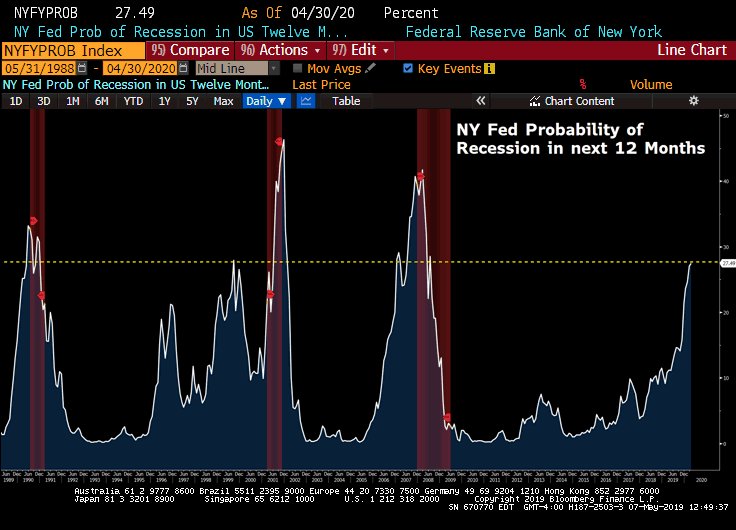

Chart 1: NY Fed Probability of Recession in next 12 Months

Chart 1: NY Fed Probability of Recession in next 12 Months

This is up to 27%. I have to think if it clears 30% anytime this summer then we could be seeing rate cuts within 9 months.

TheDailyGold Premium #621

|

We published TDG #621, a 24-page update on Sunday morning.

Some investors want a growth-type of company (in the precious metals sector) without having to take on the usual, high risk. These are hard to find given the lack of a bull market in Gold.

However, I think we own one and the second one, we profiled in the update. In a stable Gold price environment over the next 2 to 3 years this company could have upside of 150%. If Gold returns to $1800 in that time frame, the stock could have 5x upside. The stock is correcting now and we gave a clear buy target. Its a level with significant confluence of support.

The sector is oversold now but broken. We want to see it get more oversold and then reach strong support levels. That's the time to be bullish again at least for a rebound. If the fundamentals align (rate cut) than the sector can rocket higher.

Consider a subscription as we can keep you abreast of sector developments and get you invested in the companies with 3x, 5x and 10x potential.