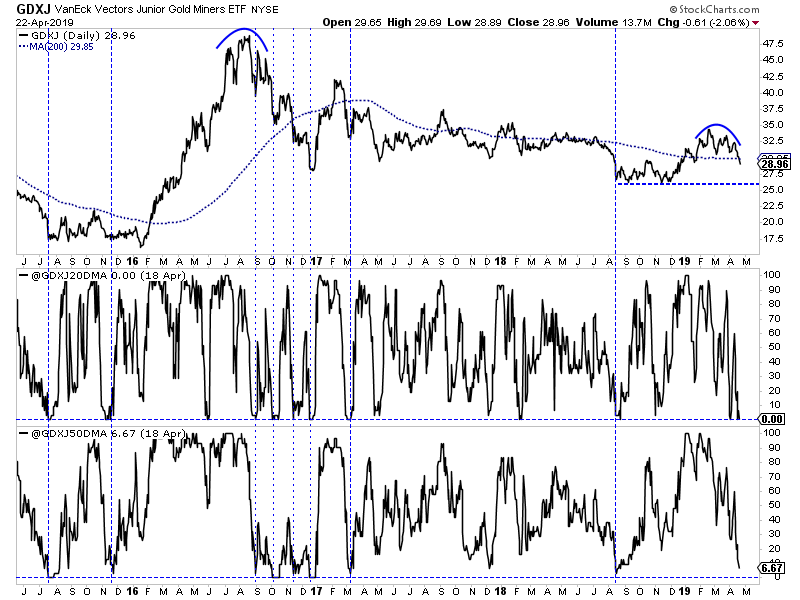

Chart 1: GDXJ Breadth Indicators

We plot GDXJ along with the percentage of GDXJ stocks (the top 33 holdings) which closed above the 20-dma and 50-dma.

The percentage for both moving averages hit 0% after Monday. Its the 9th time its happened over the past 4 years. The comparable to today is the peak in summer 2016 because today 50% of the basket closed above its 200-dma. So GDXJ is extremely oversold on a short-term basis but not oversold on a long-term basis (yet).

TheDailyGold Premium #618

|

We published TDG #618, a 22-page update on Saturday night.

We were short the sector via JDST but we sold that a day too early. Sometimes very oversold becomes extremely oversold. That is what happened.

The rounding tops on GDX and GDXJ as well as the unwinding of the rate cut trade leads me to think the miners could end up retesting the lows of late last year. Should we get a sharp snapback rally, I'd entertain re-buying my hedge.

As we wrote in our editorial, if inflation picks up it will be positive for Gold after the market has "priced out" the rate cut. So we don't want to be full on bearish for long. A massive double bottom in GDX and GDXJ in summer and fall would be a very bullish technical development.

Consider a subscription as we can keep you abreast of sector developments and get you invested in the companies with 3x, 5x and 10x potential.