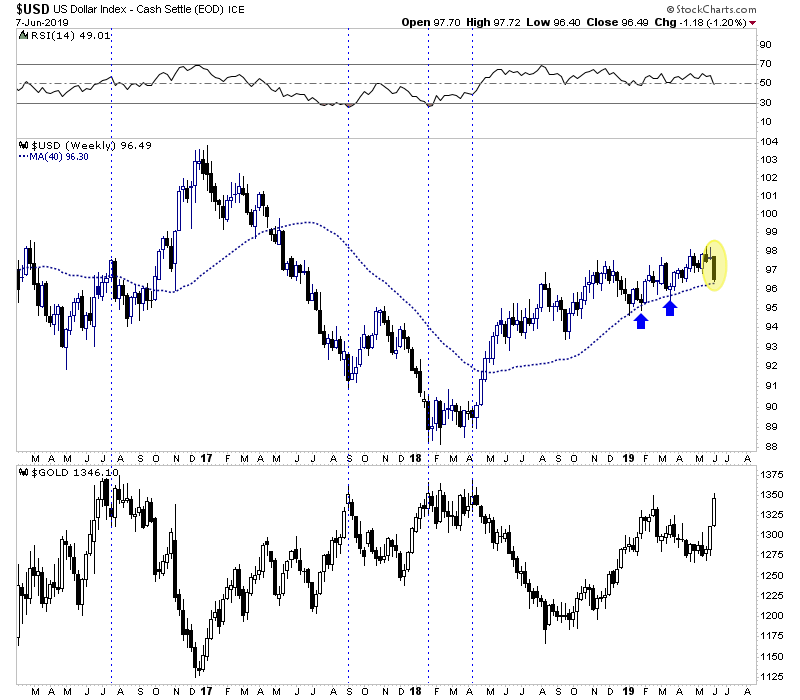

Chart 2: US Dollar & Gold

Here is the weekly candle chart of both the dollar (top) and Gold.

Note the position of the dollar the 4 other times Gold was testing that wall of resistance. It was trending up already in summer of 2016 and it already had declined quite a bit in 2017 and early 2018. Now, Gold is a hair away from the wall but the dollar a week ago was at a 2-year high.

What happens to Gold if the dollar cracks here?

TheDailyGold Premium #625

|

We published TDG #623, a 14-page update on Sunday morning. We've condensed our updates and eliminated some filler material to focus on the major developments every week.

Right now, there are at least a handful of great buys out there in junior land. Let me tell you about one we bought last week and another we are buying this week.

The first company will become a junior producer soon. It has a market cap below $30 Million. Within 3 years it could reach 100K oz Au/yr. As long as Gold holds above $1200, this stock could double or triple in 12-18 months. If Gold goes back to $1800 in 2-3 years? This stock has 10-bagger potential. A bull market only enhances the potential return.

The second company appears to be a turnaround situation. Its extremely cheap and the stock has already bottomed technically. And there is insider buying. New management could be positioning the company for a takeover. Right now its valued at roughly $40/oz in the ground and these are economic ounces.

Consider a subscription as we can keep you abreast of sector developments and get you invested in these kinds of companies with 3x, 5x and 10x potential. All of the stocks we own have upside potential in a stable Gold market.