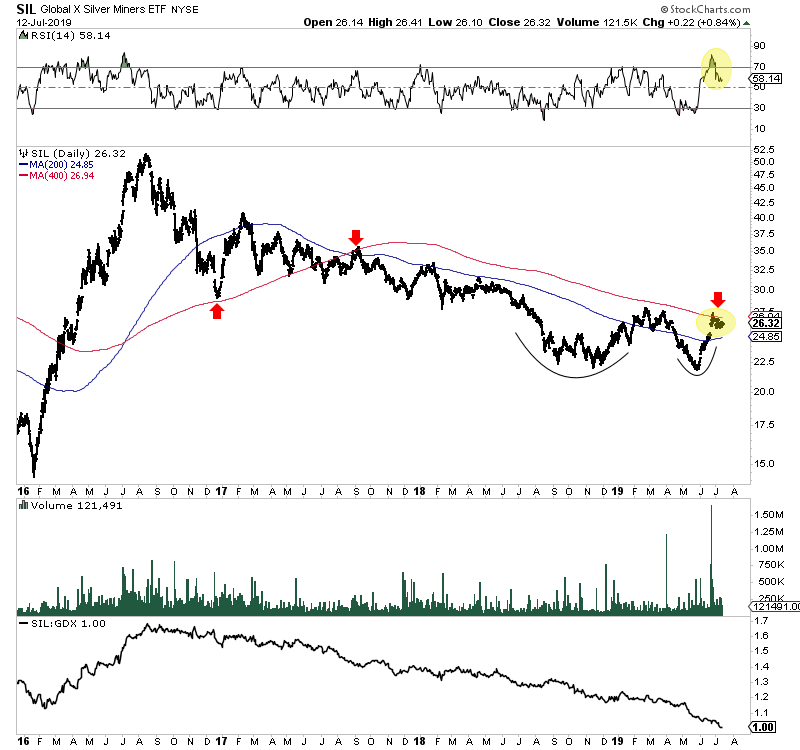

Chart 1: Silver Stocks (SIL)

Below is a daily chart of SIL with the 200-dma and 400-dma.

SIL appears to have emerged from a double bottom. At present the stock is digesting its recent surge and doing so in bullish fashion as it holds above the 200-dma which is now sloping up. The RSI is acting bullish.

SIL has remained below its 400-dma for nearly 2 years. A break above it and $27.50 would be significant. A strong push above that resistance would trigger a measured upside target of $32-$33.

TheDailyGold Premium #630

|

We published TDG #630, an 19-page update late Saturday evening. Like the past update, this one featured a lengthy Q&A section.

In one question we covered our top holding and what has to happen for this stock to make a major run. It is the stock that every investor in miners or juniors must own. It has been a big winner so far but we detailed how it could more than triple from here. I'm confident it could double as long as Gold remains above $1300.

The entire portfolio has performed quite well over the past month so there isn't any laggard or anything that stands out as too cheap at the moment. We do have a little bit of cash and some names on our watch list. One is a junior silver company that is extremely cheap right now. We think its the cheapest silver company on the market.

Consider a subscription. This move could have a lot more upside and you should utilize our expertise to make sure you are in the stocks that will perform.