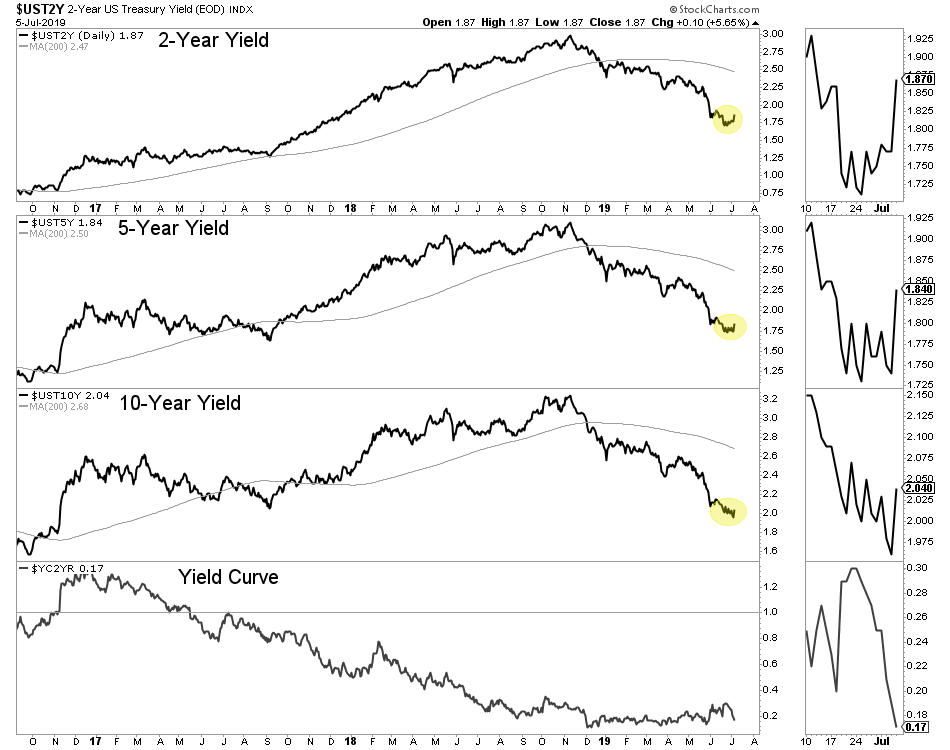

Chart 1: Bond Yields

The rebound in bond yields could put pressure on Gold as it retests its breakout and tries to battle against resistance at $1420/oz.

Right now the 2-year yield is 0.51% below the Fed Funds rate, which means two rate cuts. One is a near certainty.

TheDailyGold Premium #629

|

We published TDG #629, an 19-page update on Saturday evening. The Q&A section of the update totaled 4 pages. We discussed, among other things, deflation, Silver and how to position if you are currently in 100% cash.

Gold and gold stocks held up well last week considering the news. Technically it looks like Gold should retest its breakout and gold stocks will continue to consolidate. The dollar has rebounded and so too have bond yields. My guess is one rate cut is priced in but not two. If and when the market thinks a second cut is coming (likely September) then Gold could close above $1420 and move towards the low $1500s.

The entire portfolio has performed quite well over the past month so there isn't any laggard or anything that stands out as too cheap at the moment. We do have a little bit of cash and some names on our watch list.

I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far to many companies. You seem to sift through the best and recommend a simple more condensed list with big upside.

I am a big fan. I subscribed to 4 Gold investment letters. I cancelled the other 3. You deliver the goods! Thank you.