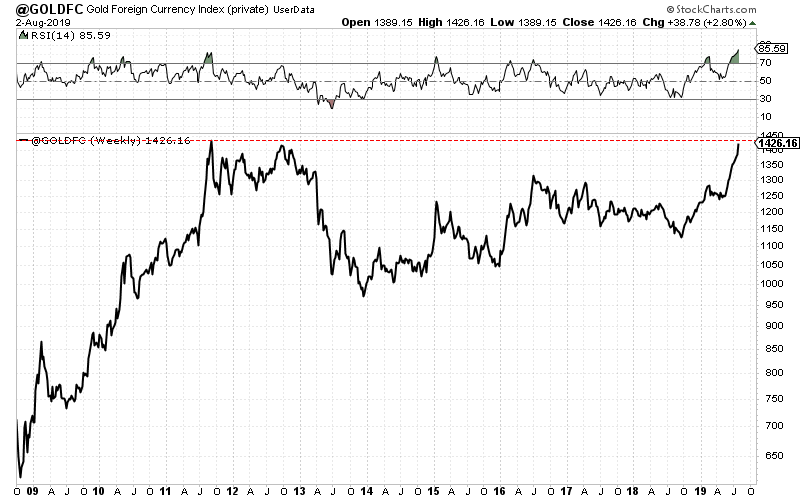

Chart 1: Gold vs. Foreign Currencies

Here is the weekly chart of Gold/FC.

It closed the week at its second highest weekly close ever. It's closing in on an all time high!

To put this in dollar terms, it would be like Gold trading at $1890/oz. Basically the Gold price is at or extremely close to an all time high against every major currency except the Euro and the Dollar.

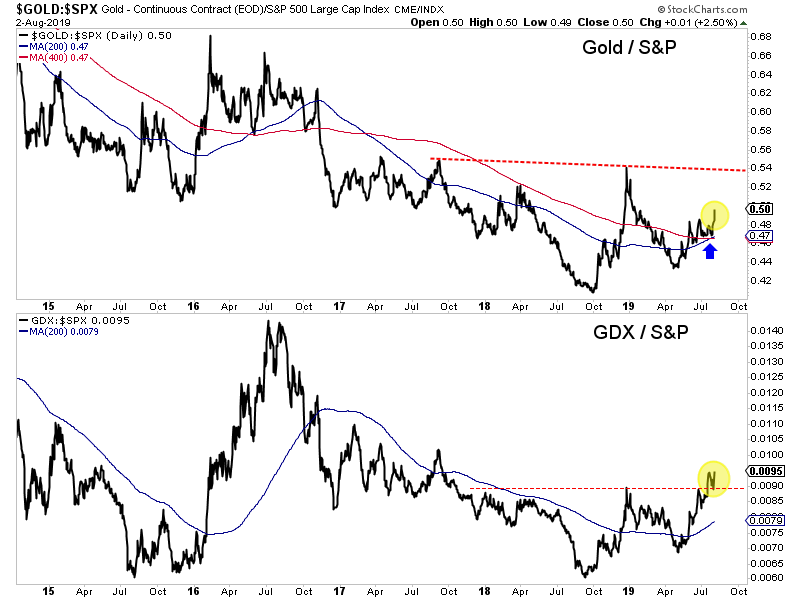

Chart 2: Gold & Gold Stocks vs. S&P 500

Chart 2: Gold & Gold Stocks vs. S&P 500

Here we plot Gold against the stock market and then gold stocks (GDX) against the stock market.

The GDX to S&P ratio has already broken out.

The Gold to S&P ratio has been a hold-out for such a long time. If that ratio can break above 0.54 (which would mark a 2-year high) and sustain it, it would be very, very bullish for the sector.

TheDailyGold Premium #633

|