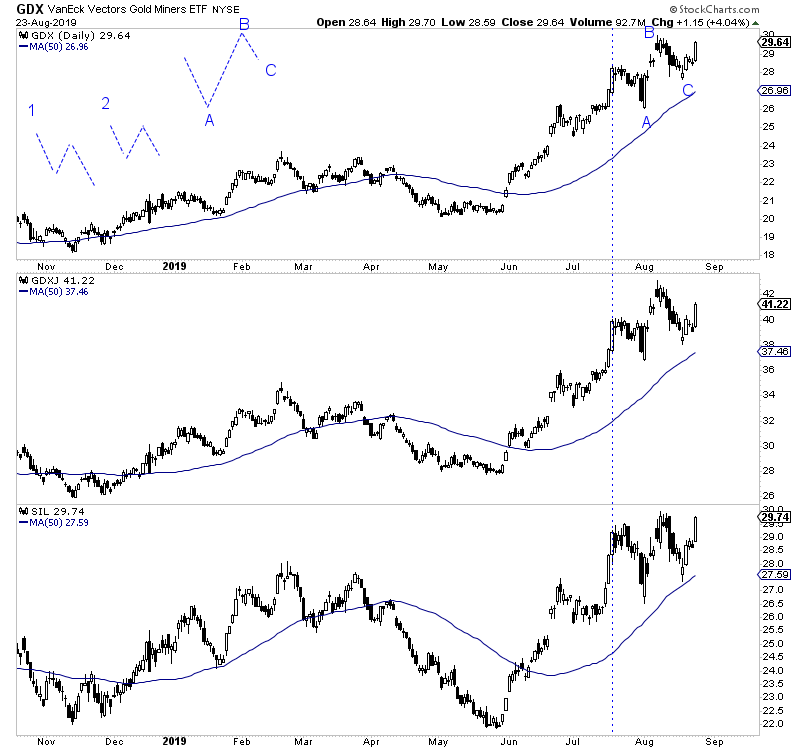

Chart 1: Running Corrections in Miners?

Below we plot GDX, GDXJ (middle) and SIL (bottom). In the top left corner of the image we plot 3 forms a correction usually takes.

Most corrections are like number 1. Some are like 2, which implies a strong market because the A and C legs end at the same point.

However, the third one is a rare correction called a running correction. This is when the market is so strong that when the correction ends, the price is where it was when the correction started. In short, the C leg finishes where the A leg (or the correction begins).

SIL's correction appears to be like #2 while GDX and GDXJ have formed running corrections. Only time will tell but this would be quite bullish for the short-term outlook.

TheDailyGold Premium #636

|

We published TDG #636, a 33-page update that contained some of our best work to date. If you are on the fence about subscribing, now would be a good time to start.

The update included a report on a junior producer which could be a 10-bagger in the next 3 years. We showed the math and exactly how it could happen. The company has a management team that has done it before and they have economic projects. And no, they don't need the Gold price to rise. It's just that if its at $1800 in 3 years and the company executes, then the stock could be a 10-bagger.

The update also included a few pages of Q&A plus 14 pages of charts on all of our holdings plus a few on the watch list.

We also covered one junior that has been a bit disappointing. We expect this company to be one of the biggest silver stories of the next few years. Lucky for you, the stock is correcting and could present an attractive entry point very soon or by the end of the year.

And for those of you who are looking for larger, safer metals stocks, I mentioned 3 in the update. One has been red hot but just corrected nearly 20%. (Buy strong stocks when they correct). Another just retested its breakout and the third is breaking out from a big base.

There is no doubt for the quality of work and expertise that we share this is the best value service you are going to get. Other services charge hundreds or even thousands of dollars and could give less of a shit about their subscribers. Without my subscribers I would have nothing. I work very hard to earn their trust. I look forward to you coming on board.