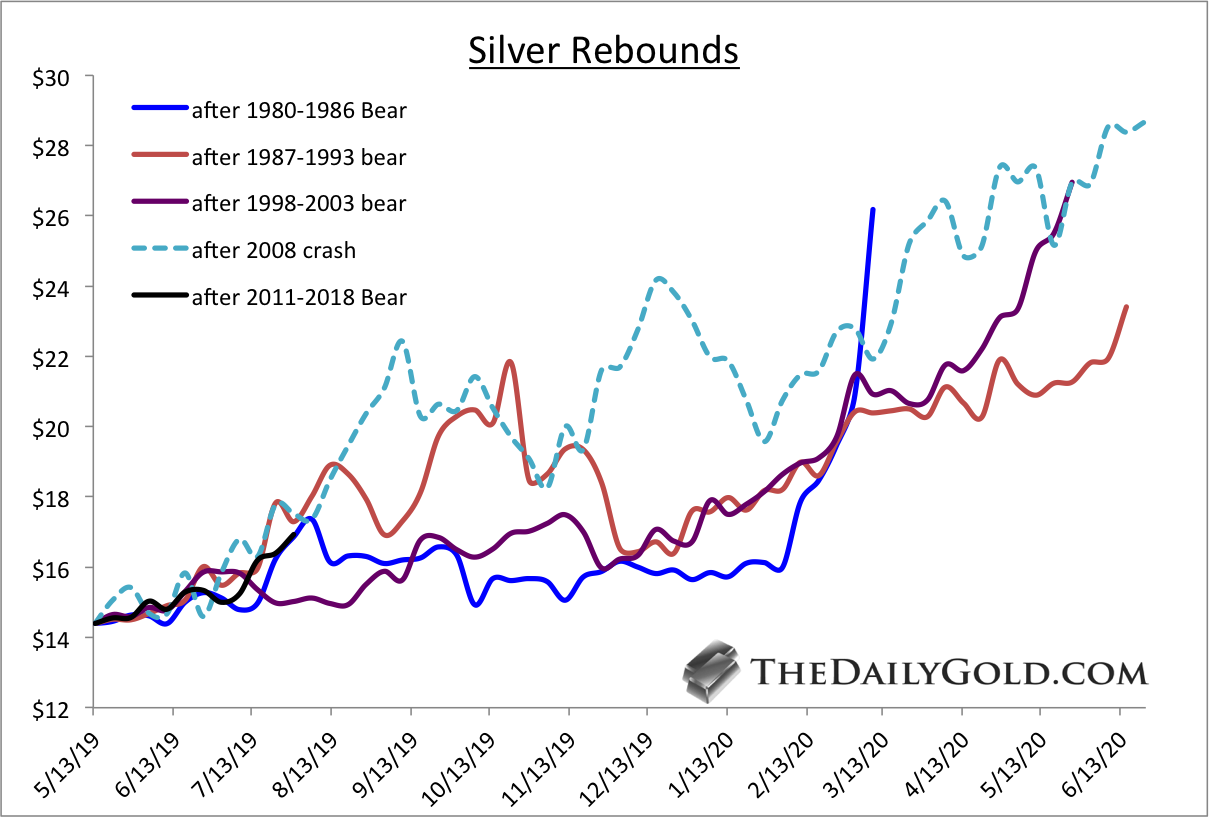

Chart 1: Silver Rebounds

In the chart below we plot the rebounds in Silver following its 4 mega-bear markets and the crash during the global financial crisis.

If Silver follows the average of the 4 rebounds it would reach $23.50 by the end of March 2020. That's less than 8 months from now.

TheDailyGold Premium #634

|