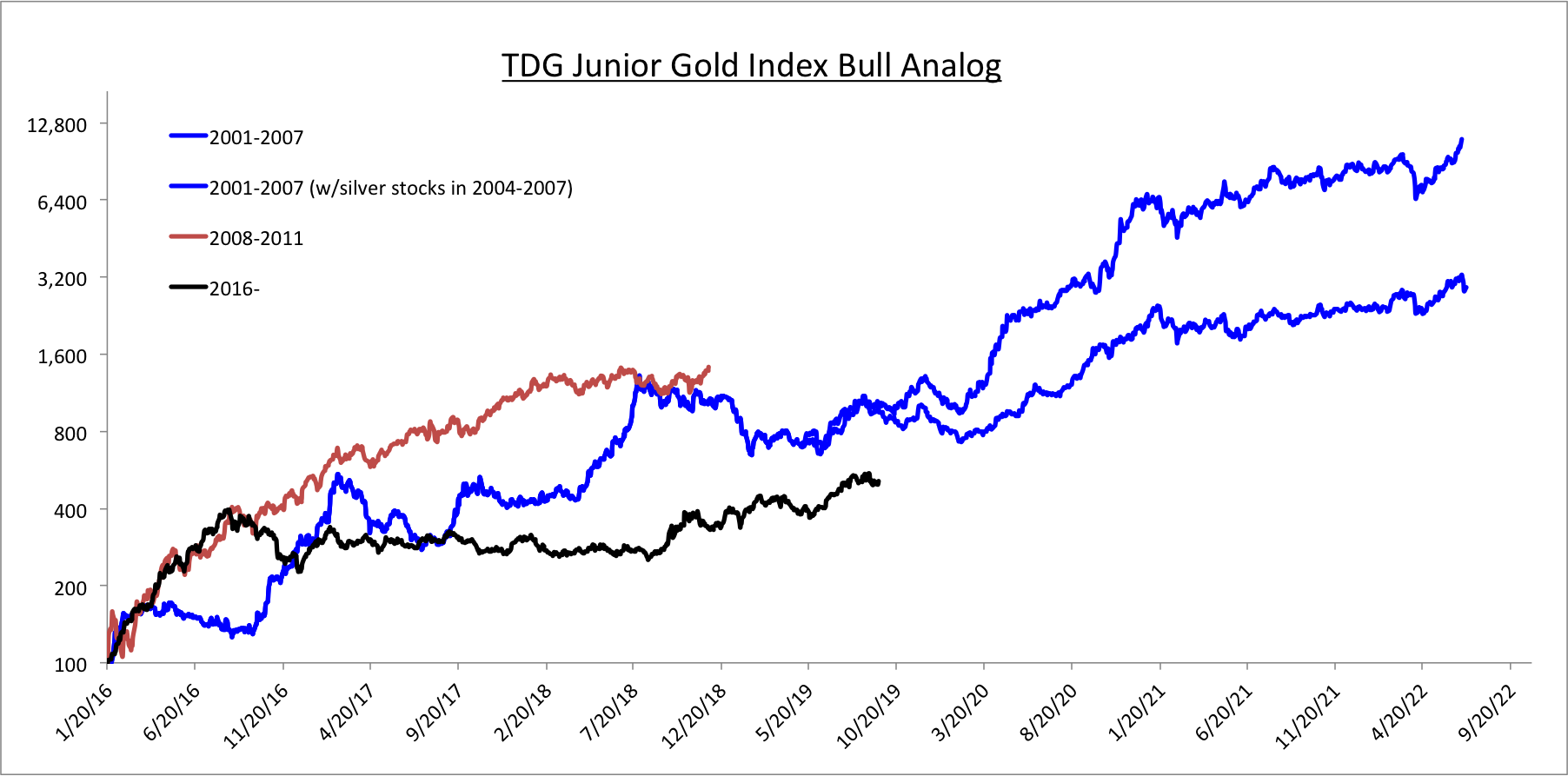

Chart 1: TDG Junior Index Bull Analog

Some juniors have held up quite well (black) so far. But plenty of good ones have corrected. I have my eye on a few...

TheDailyGold Premium #640

|

I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far to many companies. You seem to sift through the best and

recommend a simple more condensed list with big upside.

I learn more about what to expect in the PMs from your newsletter and updates than just about any other source. I doubt there is another one with a better record for accuracy and objectivity on the PM markets.

Subscribe for Only $149

We published TDG #640, an 18-page update Sunday.

Last week we updated a report on one of our highest potential exploration companies. This week we updated a report on probably our favorite exploration company.

This company ticks all the boxes and more. And it remains a great buy even though its not as cheap as a few months back when we first bought it. It has corrected some but still has 3x to 5x potential. I'm very confident in its future success. The company has an enterprise value below $100 Million but they have a project that could get them acquired for much more. If exploration goes really well, maybe +$500 Million.

We also noted a potential addition to our watch list. Its a junior explorer that has seen great results and has corrected and consolidated for nearly 12 months. I've heard very good things about the company but want to confirm it for myself.

As for the sector trend, a rebound has begun and the question is does it fade quickly and a larger correction resumes? Or does it rally back to the highs and form a bullish consolidation? This week is also the end of the quarter. Let's see if precious metals can maintain recent gains into the end of the quarter.

Subscribe for Only $149

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity.

-Jeffrey M. Kern, SkiGoldStocks.com

Thanks for reading. I wish you all great health and prosperity!

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain

certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|