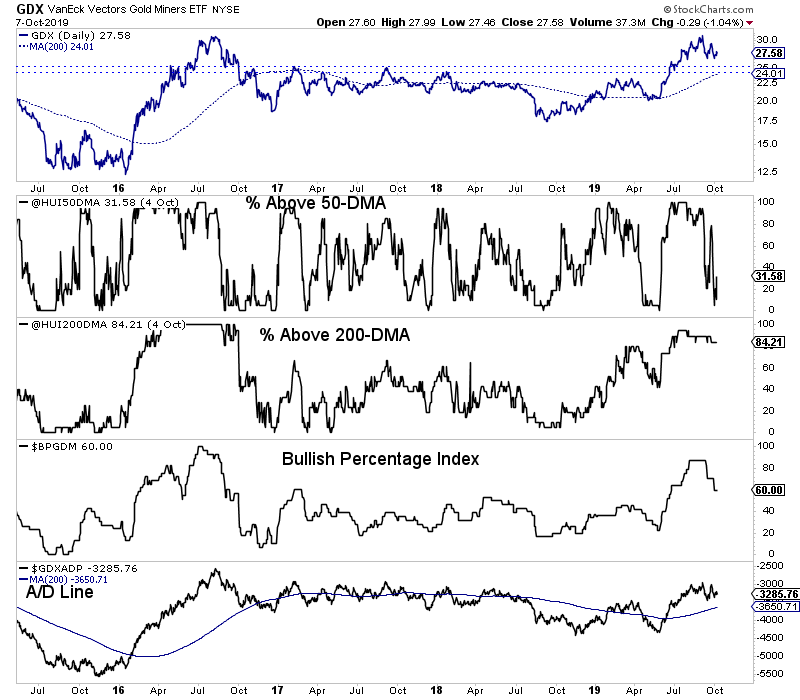

Chart 1: GDX w/ Breadth Indicators

Here we plot GDX along with various breadth indicators.

GDX's support is at $24-$25 but we should also keep an eye on the breadth indicators.

The longer-term breadth indicators like the percentage of HUI stocks above the 200-day moving average and bullish percentage index (BPI) have not reached oversold territory despite recent weakness. BPI has come down to 60% but it was below 25% when GDX held around its 200-dma in the spring. Then the percentage of HUI stocks above the 200-dma was around 40%. It remains at 84% now.

In addition to GDX testing $24-$25, we want to see some of these longer-term breadth indicators become oversold.

TheDailyGold Premium #642

|