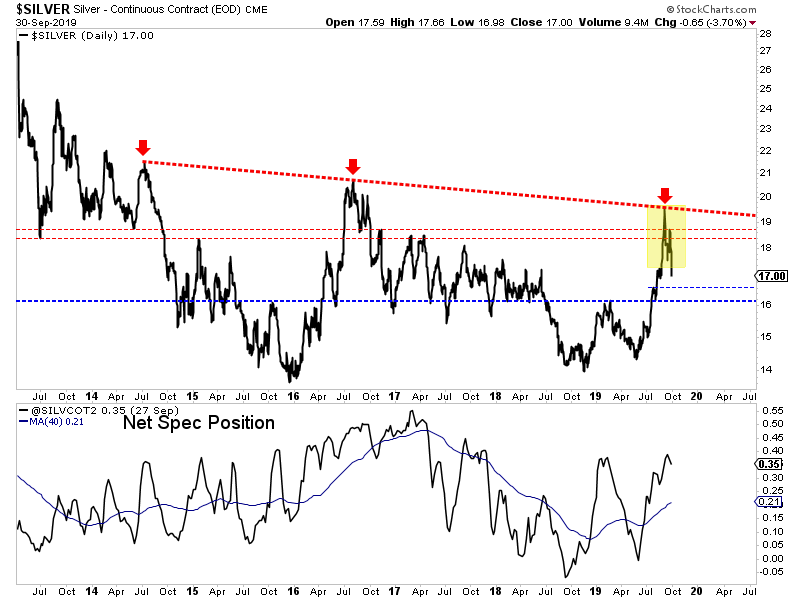

Chart 1: Daily Silver

Here we plot Silver along with its net spec position at the bottom.

The big resistance in Silver is the trendline from the 2014, 2016 and 2019 peaks. We want to see Silver establish a new base with $16 becoming a new floor in 2020. Then it could consolidate before a launch attempt above $19.

The net spec position is not stretched as it is in Gold. Note the 40-week MA of the net spec position is at 21%. Back in 2016-2017 it spent quite a bit of time at 30% and as high as 45%.

TheDailyGold Premium #641

|

I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far to many companies. You seem to sift through the best and

recommend a simple more condensed list with big upside.

I learn more about what to expect in the PMs from your newsletter and updates than just about any other source. I doubt there is another one with a better record for accuracy and objectivity on the PM markets.

Subscribe for Only $149

We published TDG #641, a 22-page update Sunday.

Here our some of our conclusions...

Corrections typically have three legs: A (down), B (up), C(down). The hard reversal mid week likely marked the start of the C wave which could take GDX down to $24-$25 and GDXJ to $33-$34. Gold has held up well thus far but given the weakness in gold stocks and Silver, we shouldn’t be surprised if Gold tumbles below $1500 and tests $1400 this fall. There’s a confluence of strong support at our downside targets.

Retesting previous resistance after a breakout is very common and that

will mark a buying opportunity when it happens....

....Last I saw the market showed a 64% chance of a rate cut in October and was pricing in only two cuts over the next 12 months. An October cut would give the sector a bump but I don’t expect that big breakout in GDX & GDXJ to occur until...

Subscribe for Only $149

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity.

-Jeffrey M. Kern, SkiGoldStocks.com

Thanks for reading. I wish you all great health and prosperity!

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain

certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|