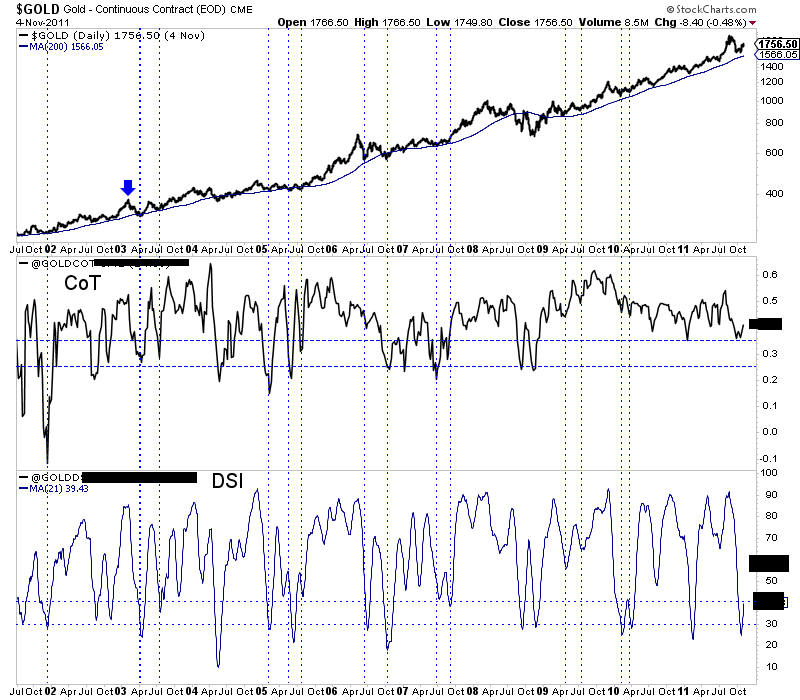

Chart 1: Gold Sentiment

We plot the Gold CoT (net spec position as percentage of open interest) and the 21-day DSI (daily sentiment index) from 2001 to 2011. Current readings are not shown.

This provides a look at where sentiment readings bottomed during the bull market years. It ranges but generally we could say roughly 30% for both. The present readings are 47% for the CoT and 37% for the DSI.

One potential comparison is the early 2003 peak and ensuing correction. The immediate low in the Gold price occurred with readings of ~27% and ~25%.

TheDailyGold Premium #645

|