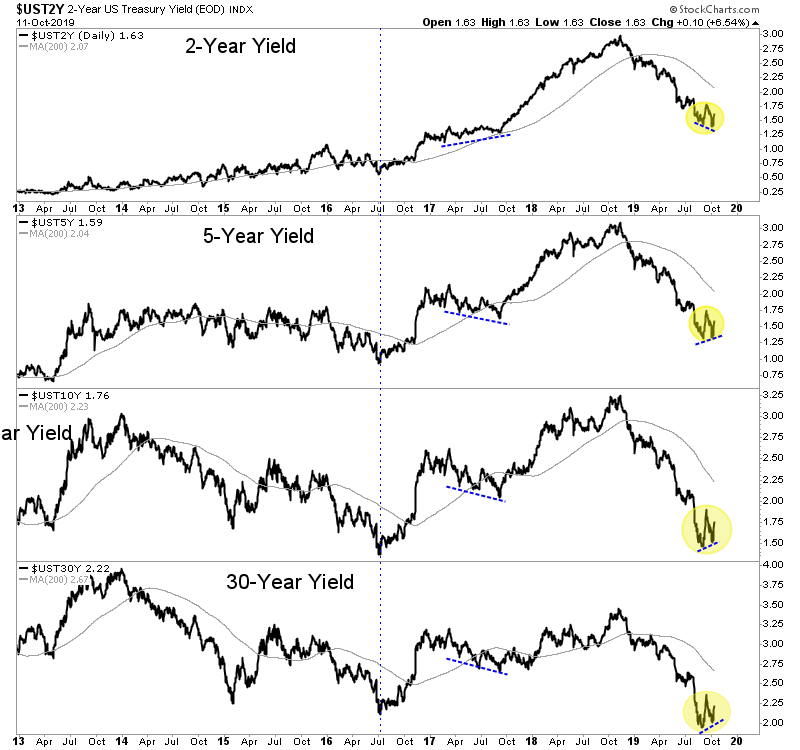

Chart 1: Bond Yields

We plot various bond yields.

Back in 2017 and into 2018 the 2-year yield was leading bond yields higher. The yield curve was flattening because the 2-year was rising faster than long-term yields. A flattening curve is bullish for stocks and bearish for Gold.

Rate cuts are obviously bullish for Gold. But so too is a steepening curve, even if all yields are rising. In that scenario, longer-term yields rising faster than the 2-year is what is bullish for Gold.

Are we now seeing the start of that?

TheDailyGold Premium #643

|