|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Leading Indicator for Gold Stocks Hits 3-Year High!

Published: Fri, 11/29/19

|

|

|

The advance/decline (AD) line is an excellent leading indicator for any market or sector. For GDX, I've noticed it has only given one false signal over the past 6 years (amid more than a handful of correct signals).

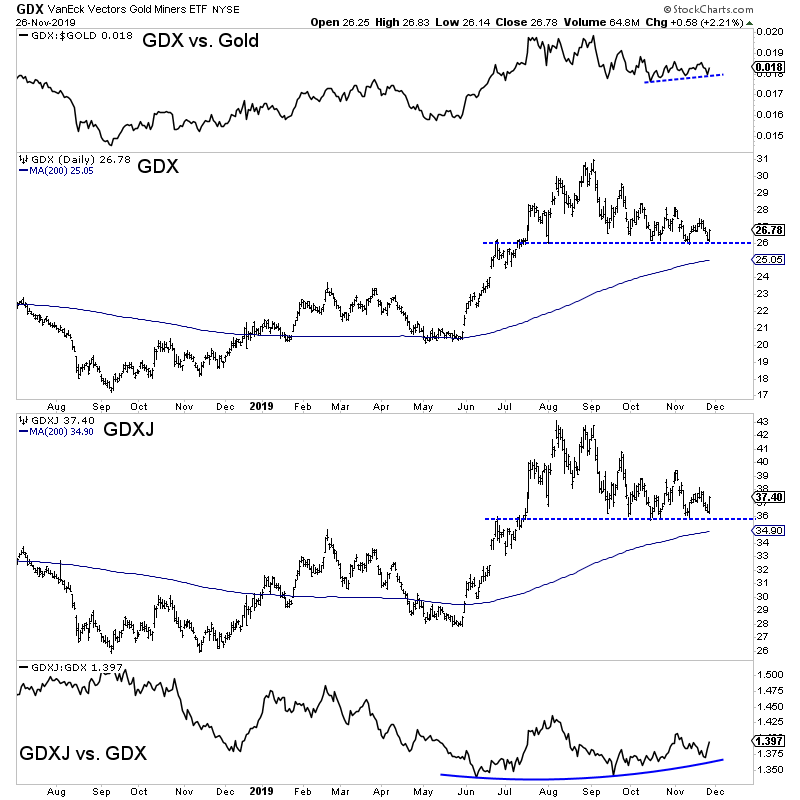

In this video, I note that just days ago the GDX A/D line hit a 3-year high! This is a very strong positive divergence. The miners continue to show relative strength. That's a good sign but sentiment in the metals suggests the metals could correct more. Not much more, but just enough to bring sentiment indicators down to very encouraging levels. Elsewhere, Gary Tanashian writes why now is different than 2012 for Gold. Gary is one of the best. Steve Saville, another of my favorite authors, writes why Gold's fundamentals are not about to turn bullish. That probably jives with what sentiment & technicals say about the metals. However, the miners continue to hold up better than the metals and may suggest the metals don't have THAT much downside. (Maybe they go sideways to slightly down). Anyway, look at the following chart. GDX & GDXJ have successfully tested support, AGAIN. GDX is holding above the 38% retracement of its move since September 2018, as is GDXJ. Furthermore, GDX has been outperforming Gold, slightly, while GDXJ has been outperforming GDX.  I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far to many companies. You seem to sift through the best and recommend a simple more condensed list with big upside. Moving onto TheDailyGold Premium.... There are buying opportunities out there. We mentioned two which are potential buy candidates after tax loss selling. We added one to our watch list. Last week we noted we bought a junior producer on weakness. We calculated that from the buy price it has 250% upside potential over the next 18 to 24 months at $1800 Gold. That position is up 24% for us. The junior explorer we bought is up 28%. There will be other buying opportunities over the weeks ahead. I think 2020 is setting up to be a fabulously profitable year. Subscribe for Only $149

Hi Jordan. Im gonna tell you something, that is with your letter that i have the most success and i very appreciate your prompt reply. Thanks again. I learn more about what to expect in the PMs from your newsletter and updates than just about any other source. I doubt there is another one with a better record for accuracy and objectivity on the PM markets. The group always enjoys hearing from you, and I think your analysis has been deadly accurate since I became a subscriber. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|