|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Why Gold & Silver Stocks are Setting Up for 2020...

Published: Wed, 11/20/19

|

|

|

I wanted to try a slightly different format. Because of the Metals Investor Forum I did not have time to publish an update over the weekend. So here it is....

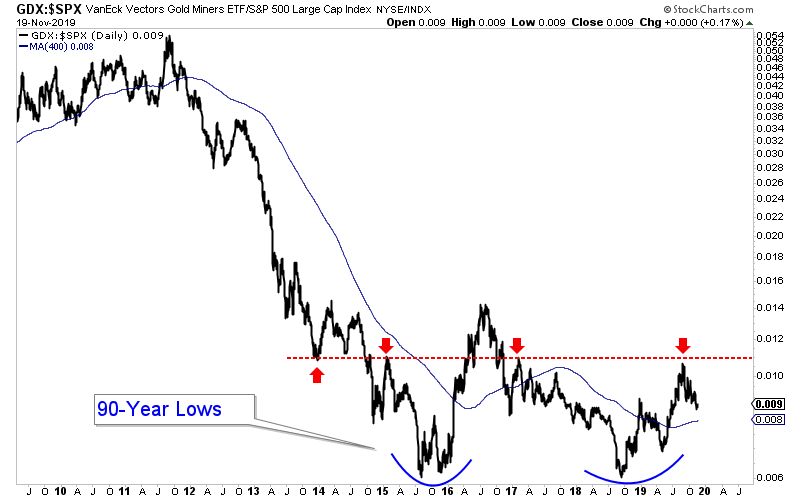

Here is my most recent editorial, published Tuesday evening. I explain why gold and silver stocks are setting up to have a big 2020. I also discussed this at MIF. Whenever the big move starts it should lead to a very strong 12 months in the sector. Here is essentially the video version of the editorial, published last week. With the potential for great upside, perhaps we can find a 10-bagger or two? In Episode #5 of the 10-bagger podcast I interviewed John Kaiser, who has been covering the junior sector for decades. He discusses, very interestingly, what you need to look for (in terms of exploration) to find 10-baggers and perhaps a 100 bagger as well! Moving onto TheDailyGold Premium.... We bought two juniors last week. One is a producer that we've been eyeing for weeks. It hit our buy target and rebounded perfectly. It does not always happen that way. But here's the rub. From that lower price, we estimated potential upside of 250% over the next 18 to 24 months if Gold goes to $1800. This company has production growth and will be successful even if Gold remains around these levels. The other one is a junior explorer and its market cap is below US $30 Million. The CEO of this company has received impressive marks from some big names in the industry. (And from me too!). He has a strong track record. I think the stock has 200% upside potential over the next 12-18 months. I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far to many companies. You seem to sift through the best and recommend a simple more condensed list with big upside. For several years I have said the Gold to S&P ratio chart is the most important. However, now it appears the miners are showing relative strength against the metals and I believe they could turn first. That means this is the most important chart now... The GDX to S&P ratio needs to surpass that red line. If and when it does, that will be an incredibly bullish signal for the sector.

|