|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Here's the One Chart to Watch....

Published: Sun, 12/22/19

|

|

|

Last week I wrote about the importance of the metals ending their correction. That could be the point when gold stocks begin a real leg higher.

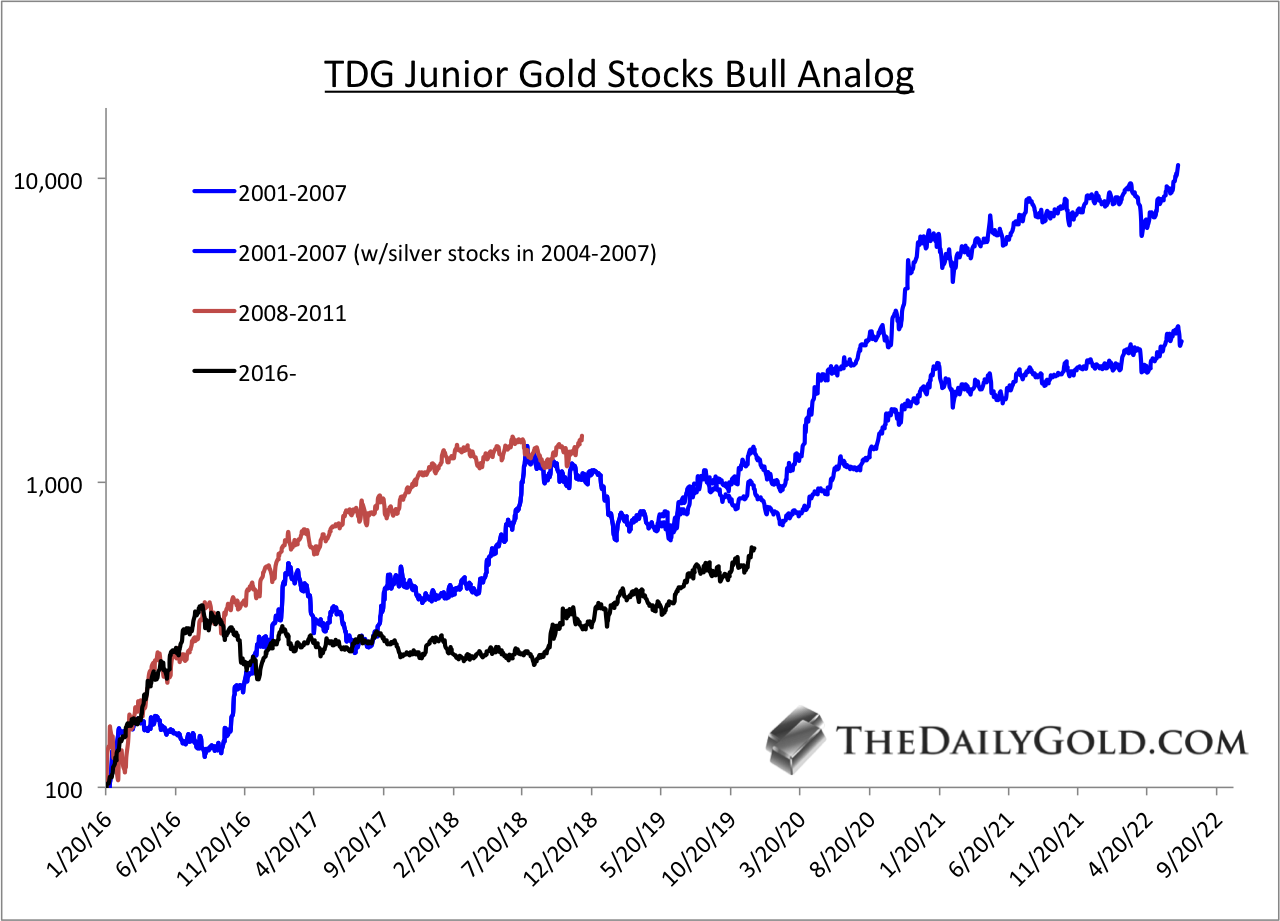

Of course we will key on the metals. But there is a specific chart we think will be an important tell for the sector. Click here for my article & that chart. A few trading days ago, we published a video analysis on Gold, Silver & the gold stocks. On the 10-Bagger Podcast I interviewed the Uranium Insider, Justin Huhn. He is confident there will be 10-baggers in this sector. We should definitely keep an eye on the other sectors in hard assets because there is even more value there, though the trend is not yet up. Turning back to Gold and junior gold stocks, here is my updated bull analog chart for juniors. This is a basket of some (not all) of the best performing juniors. It does not compare to GDXJ.

This very strong index would need to double to reach that peak of the red line and blue line (in July 2018). And there is way more upside than that if it continues to climb for another 2-3 years.  Subscribe to TheDailyGold Premium for Only $149

I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely! I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far to many companies. You seem to sift through the best and recommend a simple more condensed list with big upside. Moving onto TheDailyGold Premium... TDG #652, was an extensive 26-page update that included a company report, quite a bit of Q&A and several pages of notes on companies.

The company report was on a company that we think can be a 10-bagger in 3 years if Gold goes to $1900. The management team has a strong track record and the company is well financed to move forward. This is a stock we hope to buy a little bit lower in the next month. It is liquid enough. This company has a shot to reach $1 Billion in market cap if Gold goes to $1900 in a few years.

Here is one important thing to keep in mind: the companies that raised capital in the summer now have to deal with some of those shares potentially being sold. That can lead to excellent buying opportunities this winter.

Right now, I still think Gold & Silver could test their 200-day moving averages and that could pull miners lower. Regardless, I see buy opportunities now and I think even more will emerge in the coming weeks. Subscribe for Only $149

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|