|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Sweet Spot for Gold's Fundamentals...

Published: Tue, 01/28/20

|

|

|

In recent weeks the US Dollar has perked up but Gold hasn't sold off. Even Silver and the gold stocks have held up, though they failed at resistance on Monday. Click here to get our thoughts on why Gold can't lose this year.

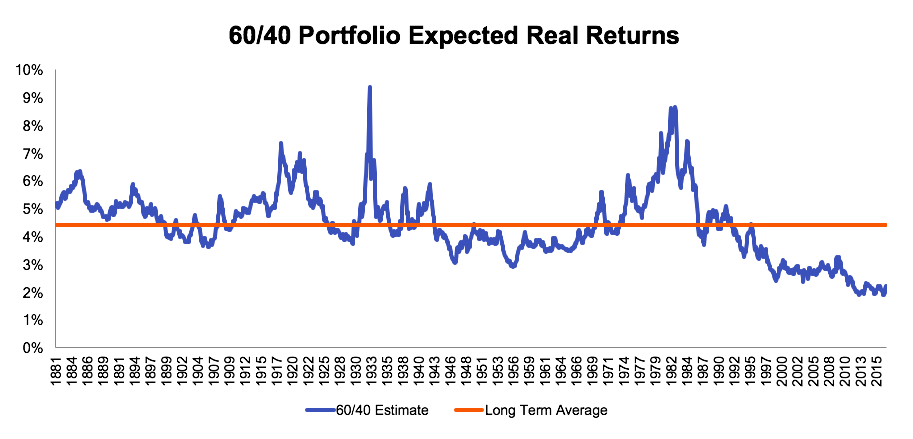

If you prefer the spoken word, consider listening to this interview in which I discuss what's going on with the dollar and bonds and the potential impact on Gold. Moving along, on episode 11 of the 10-Bagger Podcast I interviewed a gentlemen known as "Goldfinger." He won the CEO.CA stock picking contest in 2019. He shares his expertise and provides a stock pick near the end. I am a new subscriber after meeting you at the metals investor form recently. I am finding your newsletter very informative!!(well worth the money) I also just want to say that I'm truly impressed with your picks/service. I have tried others before yours with very average to below average success BTW, I couldn't be happier with your service and the stocks you recommend. I was down to ---- this time last year and now I'm up to almost ---- Next, here is an excellent chart that I just found on Twitter and it's something that is worthy of going into my book, which I just updated with a 2020 Outlook. (I will send you a PDF copy next week). Until 5-7 years ago, the two worst points for the expected return from a 60/40 portfolio were 1957 and 1999. The two most important secular bottoms in gold stocks were in 1957 and 2000. The 2015/2016 bottom in gold stocks is going to be just as historic as the other two bottoms. It's probably not a coincidence that expected returns from a 60/40 portfolio hit an all-time low just prior to that 2015/2016 bottom.  I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely! I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far to many companies. You seem to sift through the best and recommend a simple more condensed list with big upside. In TDG #658, a 21-page update, we noted that with bond yields rolling over again, the odds of precious metals testing their 200-day moving averages are plummeting. Monday's action argues that a breakout to the upside is not imminent. Subscribe for Only $149

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|