|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Near-term Risk in Precious Metals...

Published: Tue, 02/04/20

|

|

|

Since mid January Gold has pushed higher and made a new high but the rest of the sector has not. Silver and the gold stocks have traded around resistance but failed to break it. The risk of a drop to the 200-day moving averages is back in play.

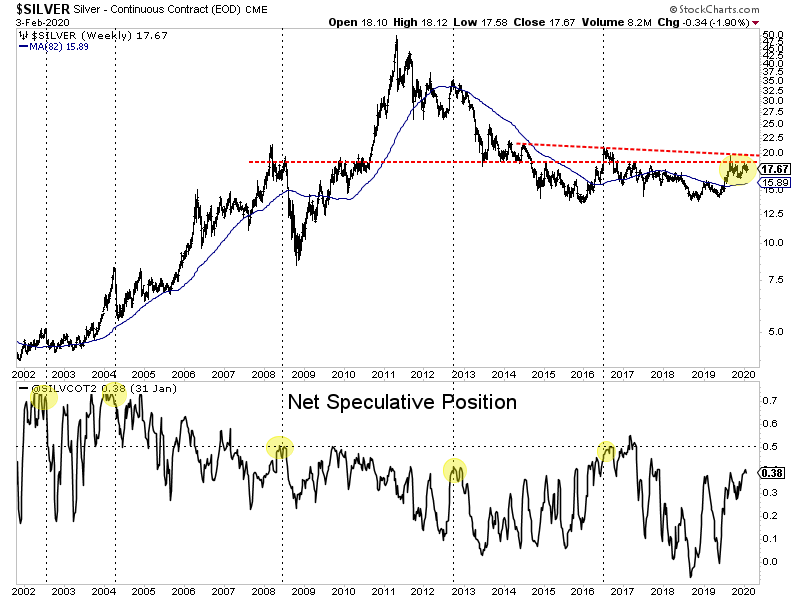

For a bigger picture view, consider this interview I conducted with David Morgan, who is one of the few precious metals analysts who experienced the bull market of the 1970s. This is a macro look at Gold & Silver and me picking David's brain about various things. Elsewhere, we know the CoT is a current issue but Gary Tanashian who is one of the best precious metals analysts gives his excellent perspective on it. Take a look. I am a new subscriber after meeting you at the metals investor form recently. I am finding your newsletter very informative!! (well worth the money) I also just want to say that I'm truly impressed with your picks/service. I have tried others before yours with very average to below average success BTW, I couldn't be happier with your service and the stocks you recommend. I was down to ---- this time last year and now I'm up to almost ---- Here is a chart of Silver & its CoT (net spec position) going back to 2002. As you can see, there is important resistance around $18 and trendline resistance just below $20. If and when Silver can reach $20, then it has a shot to reach $26 sooner rather than later. And the resistance at $18 is much stiffer than around $20.  I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely! I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far to many companies. You seem to sift through the best and recommend a simple more condensed list with big upside. In TDG #659 was a 22-page update that light on charts and heavy on text. The update included a company report, notes on other companies as well as several pages of Q&A. Subscribe for Only $149

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|